Introduction to Dollar-Cost Averaging

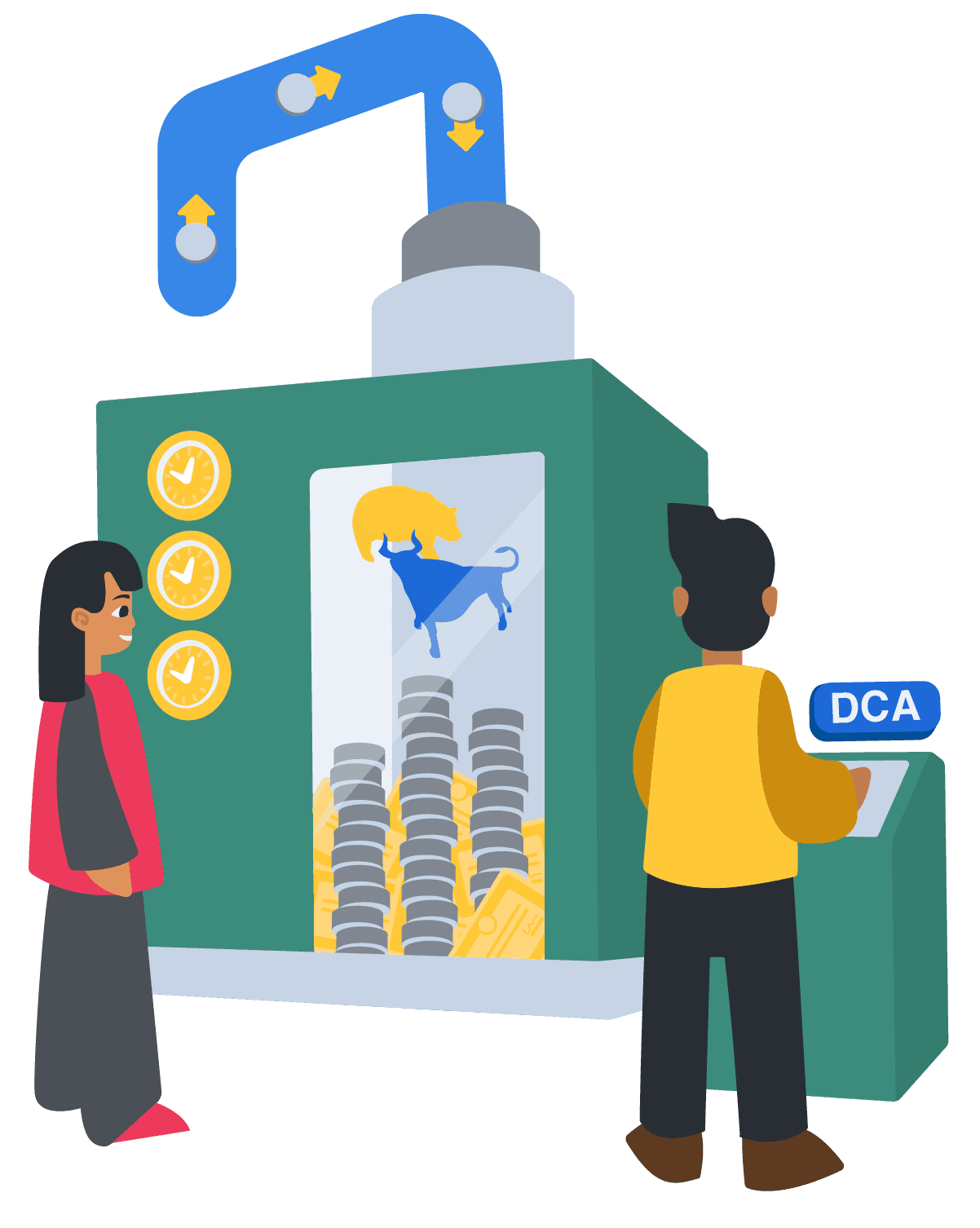

Dollar-cost averaging (DCA) is an investment strategy where individuals consistently invest a fixed amount of money at regular intervals, no matter how the market is performing.

By purchasing more shares when prices are low and fewer when prices are high, investors reduce the impact of volatility over time.

This approach minimizes emotional decision-making and eliminates the need to time the market, providing a steady, disciplined strategy for building long-term wealth with less stress.