Introduction to Impact Investing

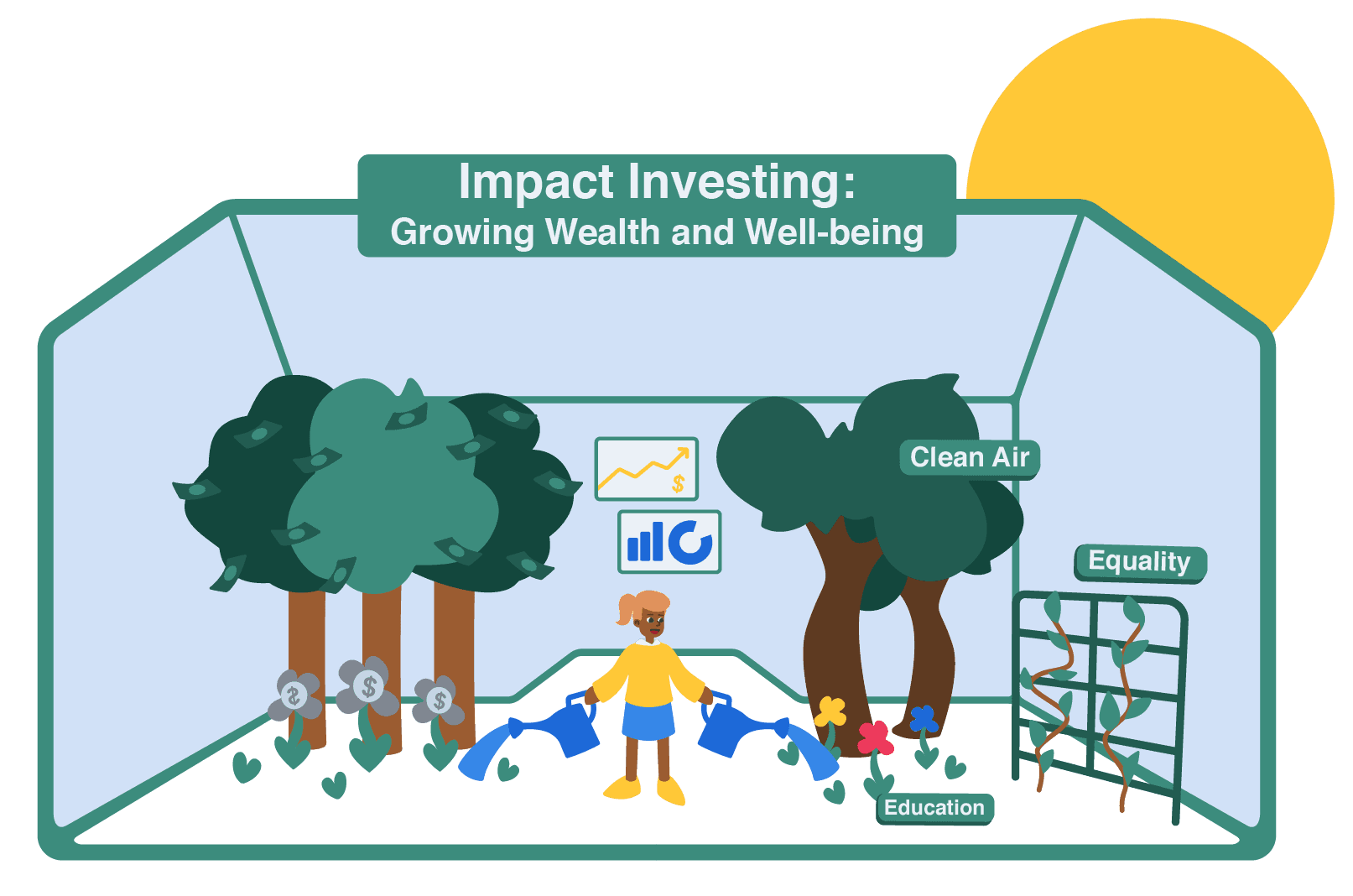

Impact investing involves allocating funds to ventures that aim for positive social or environmental outcomes alongside financial returns.

Unlike traditional investing, which focuses purely on profits, impact investing seeks measurable improvements in areas like education, clean energy, and healthcare.

By directing capital into mission-driven projects, impact investors blend purpose with profit, addressing global challenges while fostering sustainable growth and meaningful change.