Introduction to Unsystematic Risks

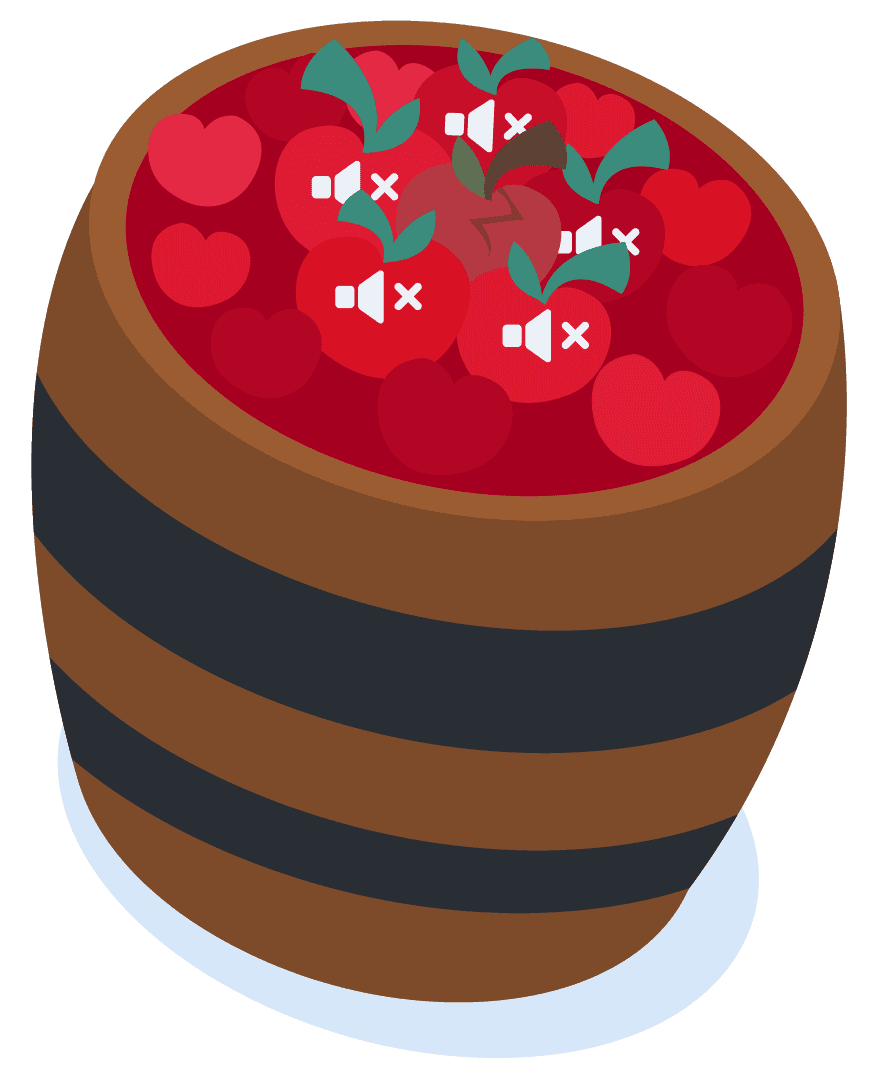

Unsystematic risks stem from company- or industry-specific factors, such as poor leadership, product failures, or regulatory changes impacting certain sectors.

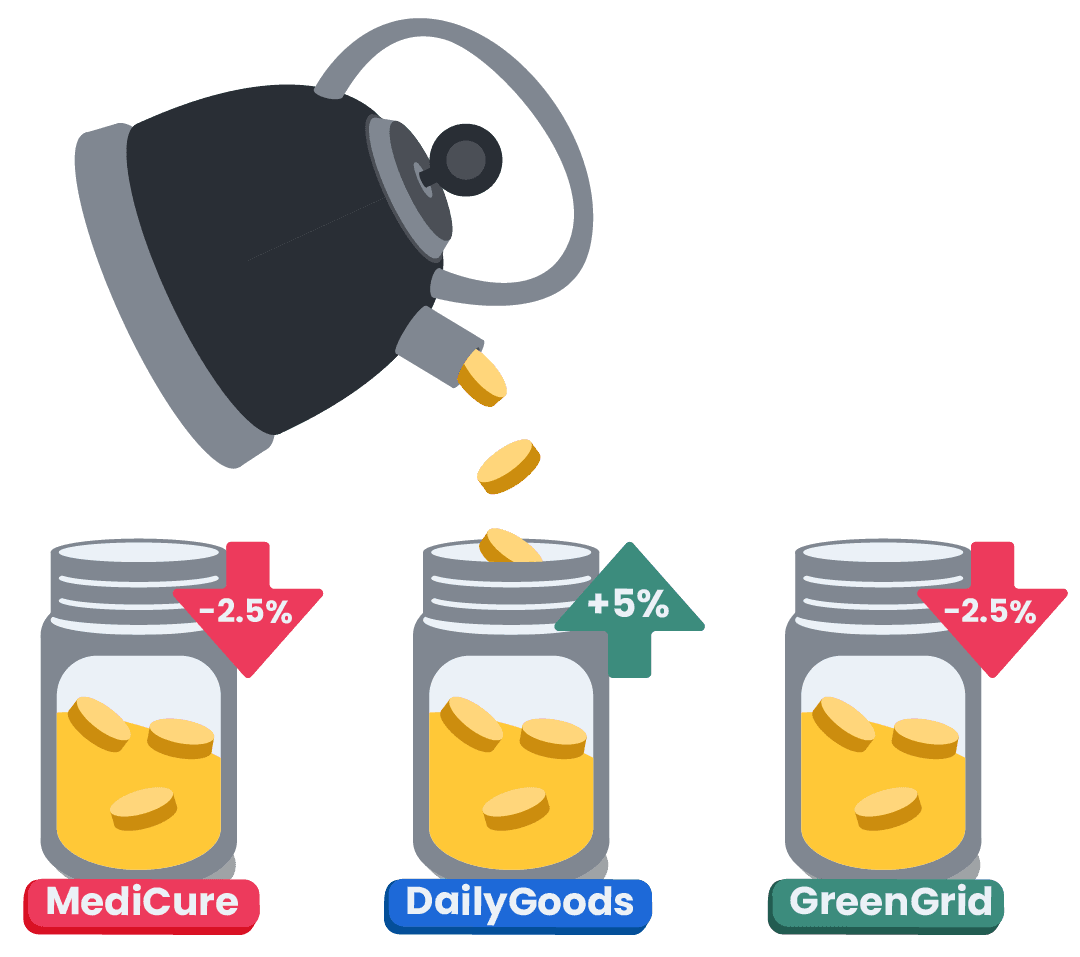

These localized risks differ from market-wide events and can be mitigated through diversification.

By spreading investments across different companies, industries, or regions, investors reduce their reliance on any single asset and limit the impact of individual setbacks, creating a more resilient portfolio.

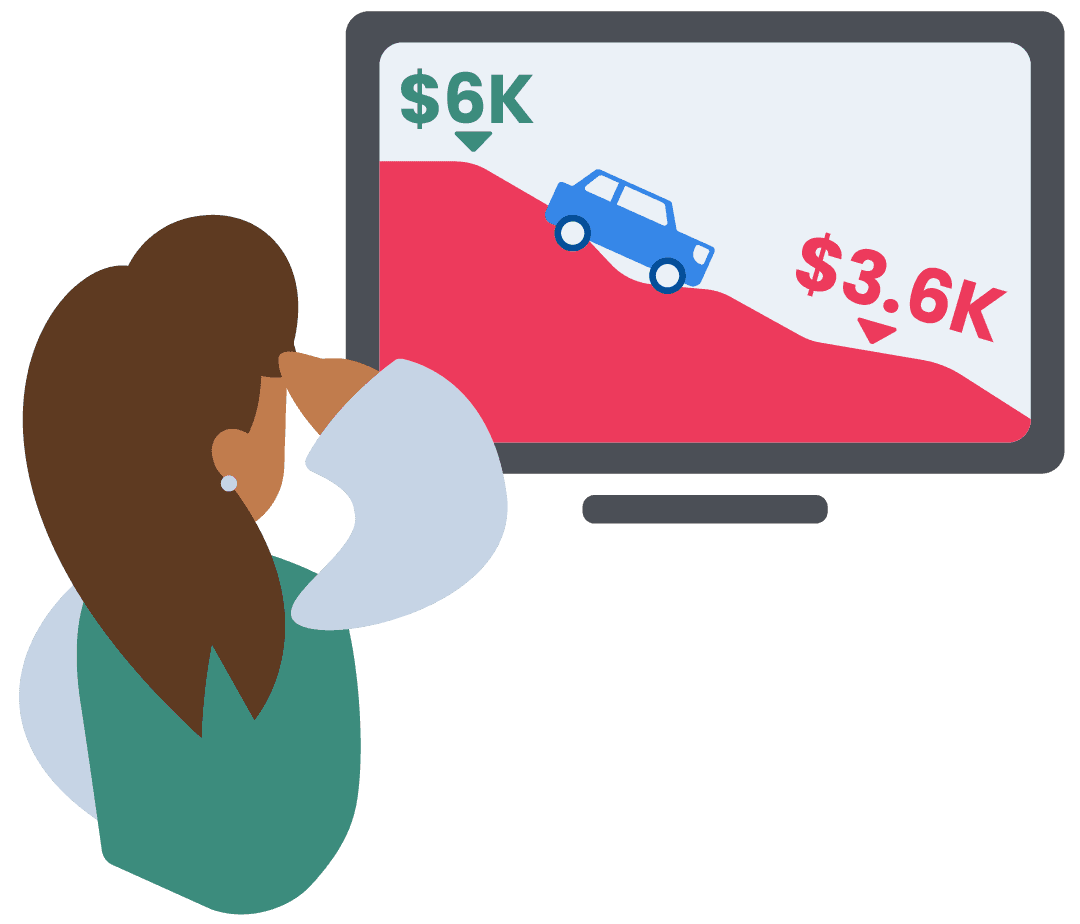

Jane’s First Encounter with Unsystematic Risk

Jane’s First Encounter with Unsystematic Risk