Introduction

Risk-adjusted performance evaluates how well an investment compensates for the risks involved.

It compares returns to risk, determining if higher returns justify added volatility.

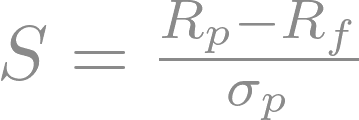

Metrics like the Sharpe Ratio (returns vs. volatility), Treynor Ratio (returns vs. market risk), and Jensen’s Alpha (excess returns vs. market) provide insights into a portfolio’s balance of risk and reward, helping investors make informed decisions about their strategy.