Introduction

Leverage involves using borrowed capital or margin to increase the size of an investment position beyond what personal funds alone would allow.

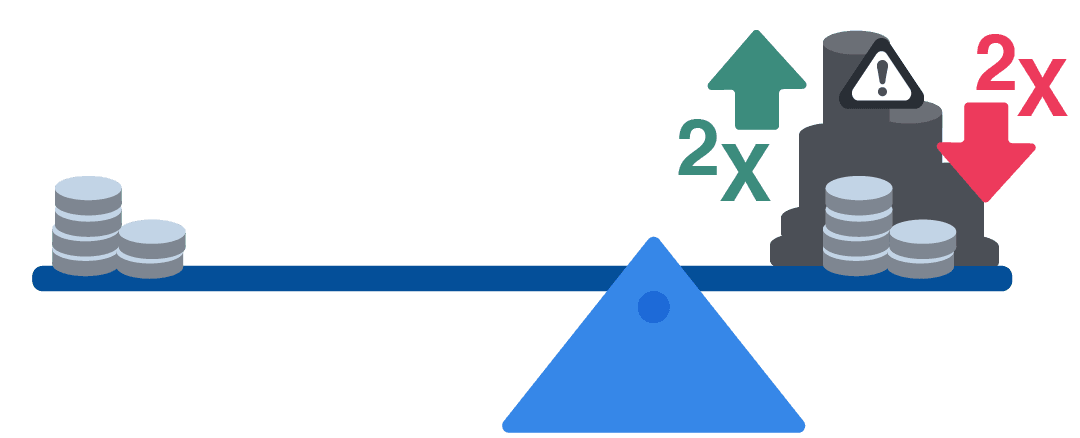

It amplifies returns when asset prices move in favor of the investor but also magnifies losses when prices go in the opposite direction.

Proper understanding of leverage fundamentals, including its impact on risk, volatility, and potential margin calls, is essential for managing its effects within a portfolio.