The Screen That Never Sleeps

Anika is diving deeper into the world of currencies. Her morning coffee is brewing, and so is her curiosity.

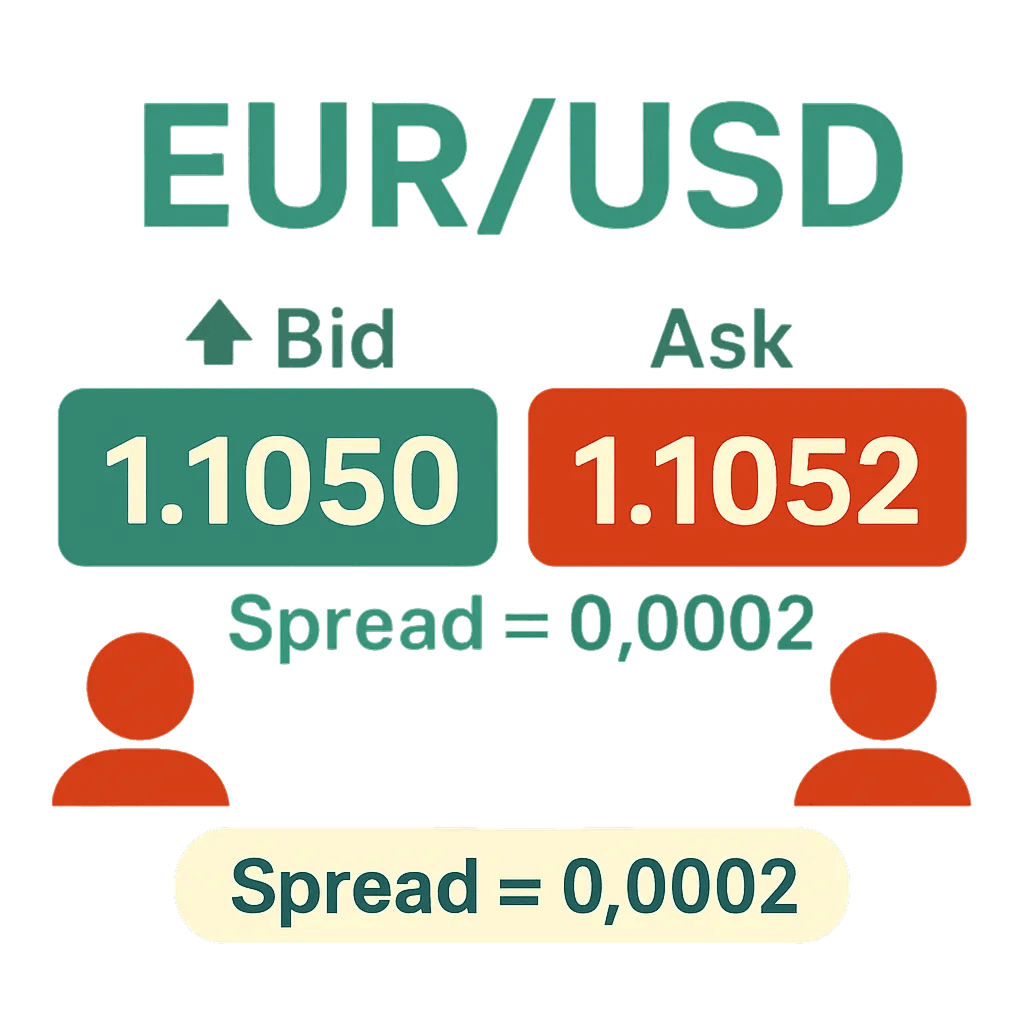

She logs into her demo trading app and sees rows of flashing numbers, green and red candles, and cryptic abbreviations.

“This looks like a cybersecurity dashboard,” she laughs. “Only instead of threats, it’s currencies fighting for dominance.”

Every tick, every color, every candle tells a story. Today, Anika begins to learn the language of the Forex screen.