Introduction to Technical Indicators

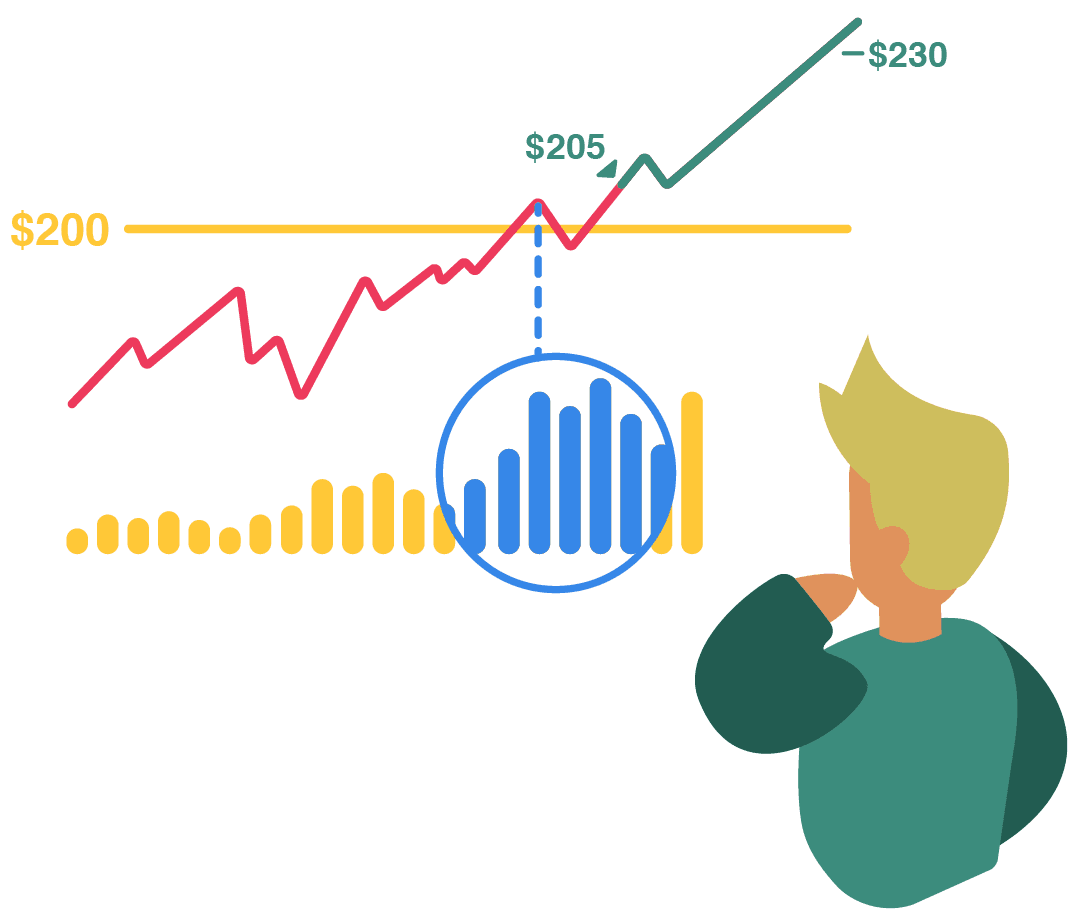

Technical indicators help traders read price data and spot market momentum.

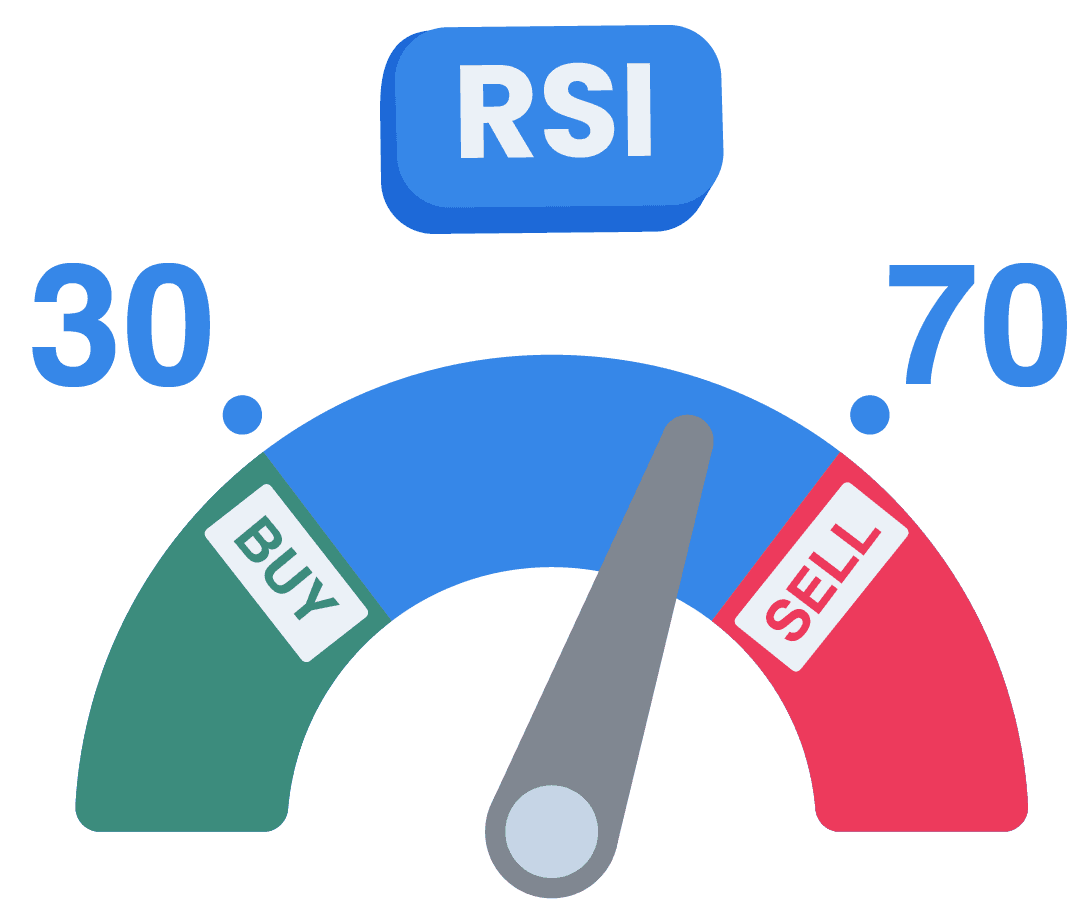

Some key indicators include the Relative Strength Index (RSI), which measures whether a stock is overbought or oversold.

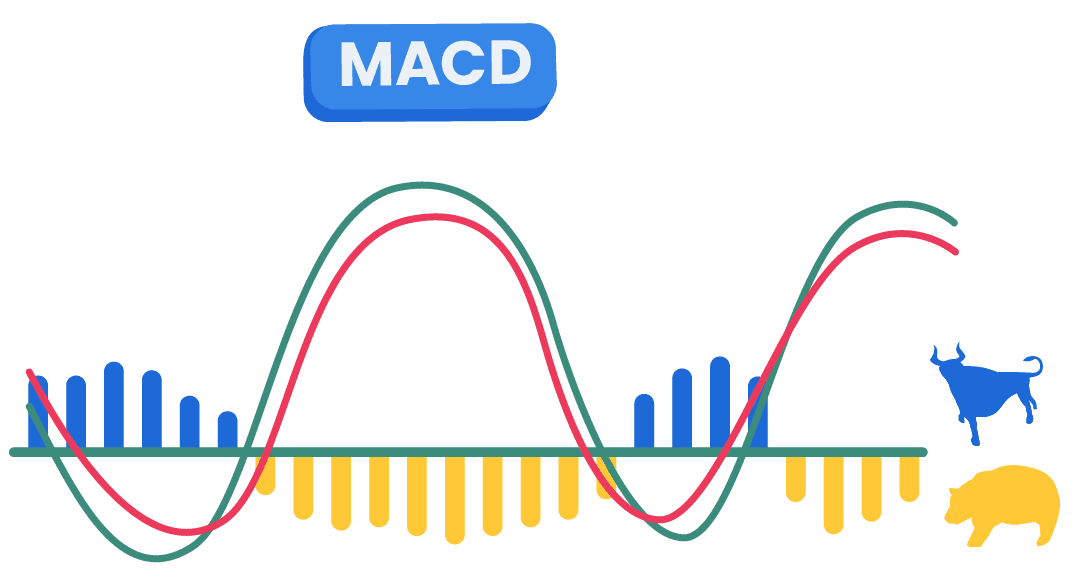

The Moving Average Convergence Divergence (MACD) tracks the difference between two exponential moving averages, signaling trend reversals.

Bollinger Bands, another popular tool, measure price volatility. These indicators provide insights into market conditions, helping investors to refine their trades.