Projecting Future Cash Flows

Projecting future cash flows involves estimating the company's revenues, expenses, and capital needs over a forecast period, typically 5 to 10 years.

This requires assumptions about growth rates, profit margins, and investment in capital expenditures and working capital.

The projections should be realistic and based on historical performance, industry trends, and economic conditions.

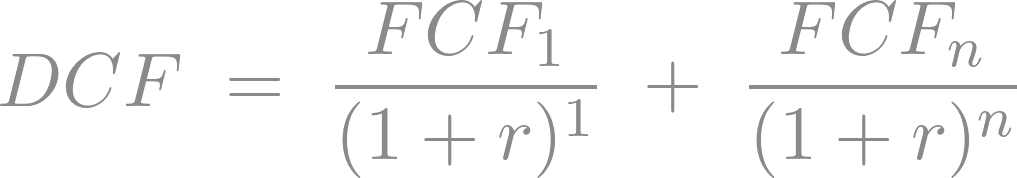

Accurate forecasts are crucial, as they directly impact the valuation outcome in a discounted cash flow (DCF) analysis.