Introduction to Order Types

Order types tell your broker how you want your trade executed, letting you control factors like price, timing, and risk.

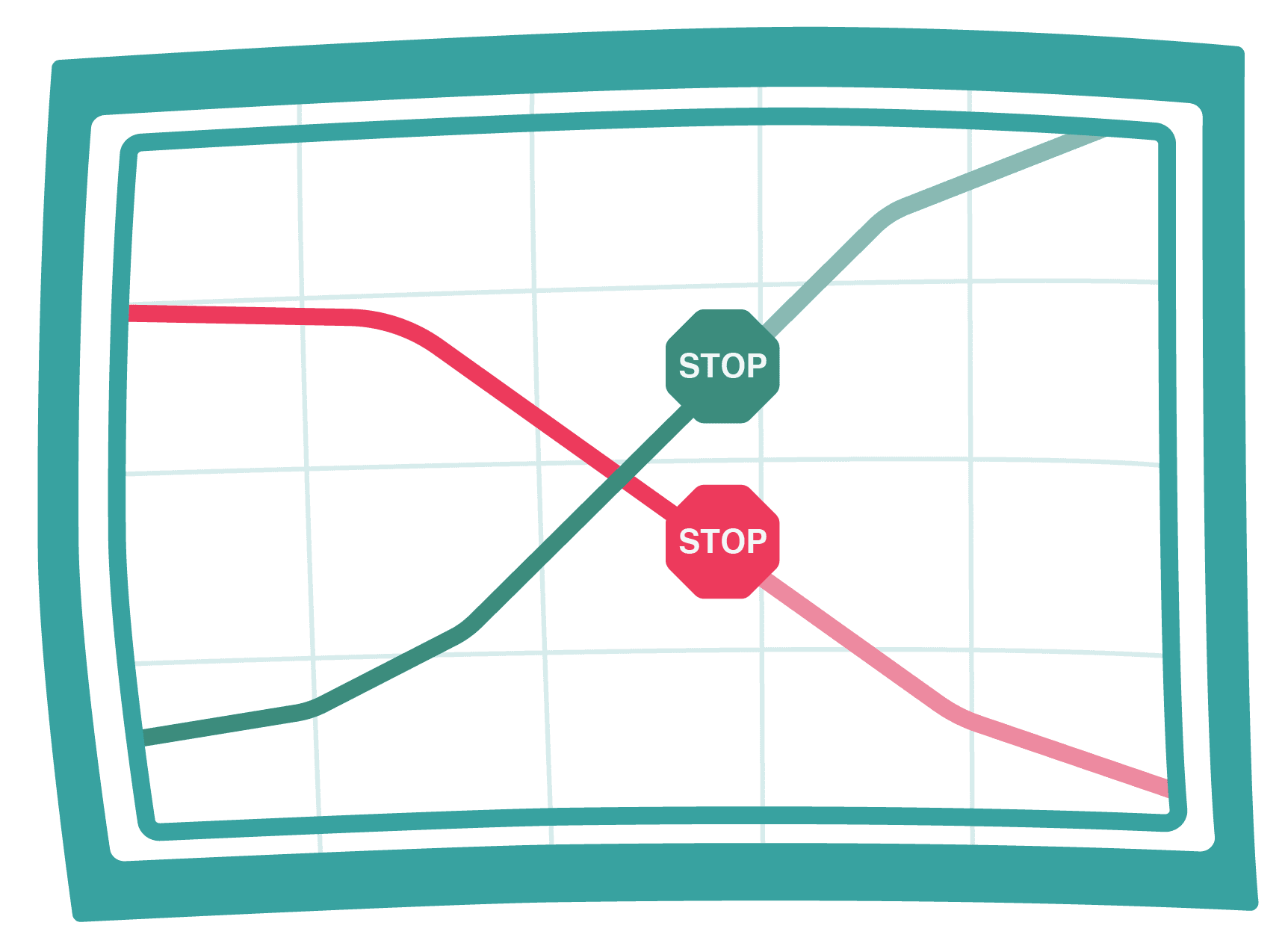

Many traders default to simple market orders, guaranteeing quick execution but sacrificing price precision, only to discover they’ve paid more (or sold for less) than anticipated in fast-moving markets.

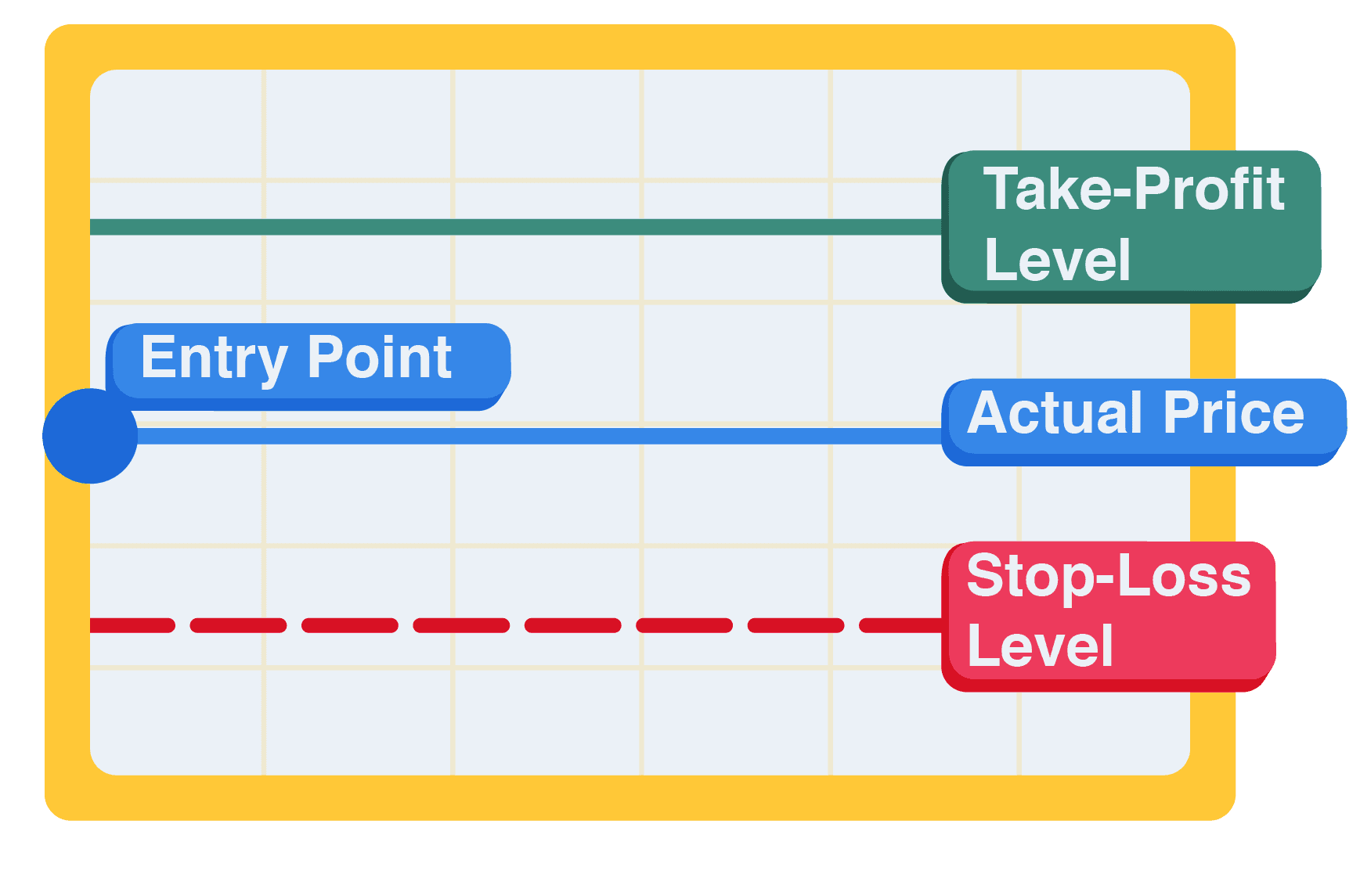

By using different order types, traders can:

- Avoid unnecessary losses.

- Secure better entry and exit points.

- Manage risk effectively.

Let’s join Daniel to master various order types.