Introduction to Options

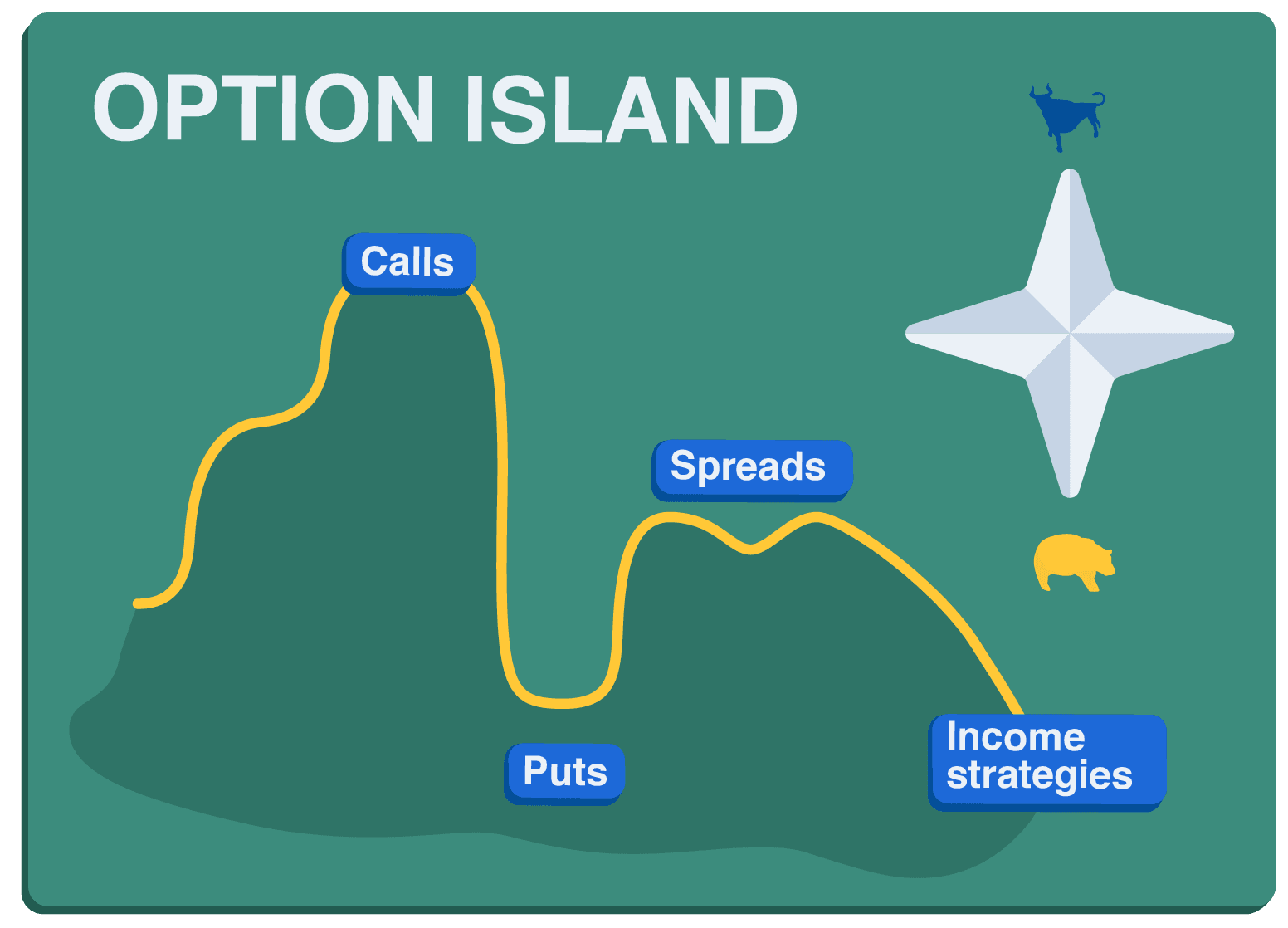

Options give you the choice to buy or sell something later, without committing upfront. A call option lets you buy, a put option lets you sell.

Each options contract sets a price and an expiration date. You have no obligation to go through with the deal if it doesn’t suit you.

Since options derive their value from the underlying asset, like a stock or commodity, they’re called derivatives.

Investors use them to manage risk, speculate on price moves, or enhance their strategies.