Private Equity Value Creation Strategies

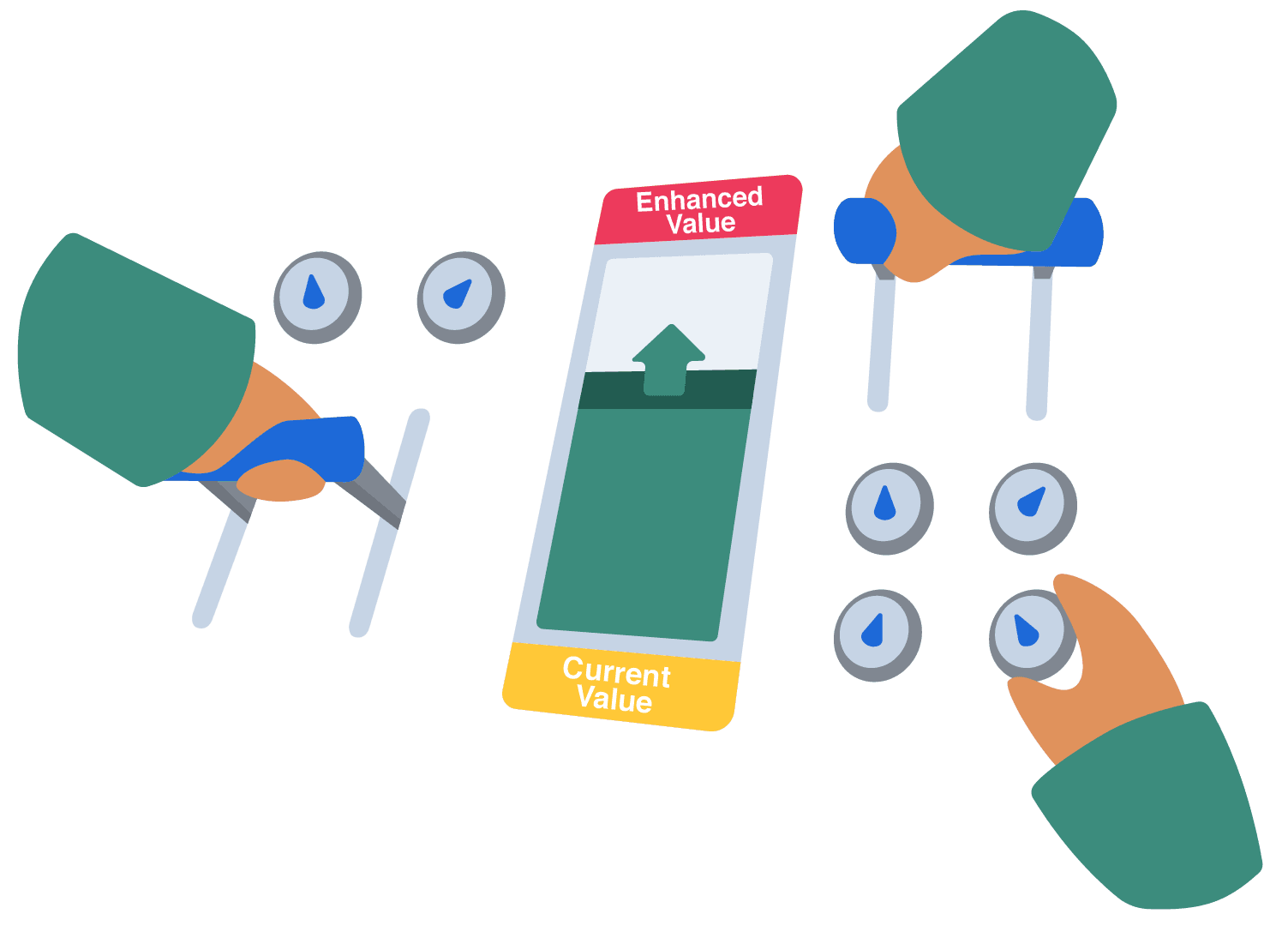

Private equity firms don’t just invest passively. They transform operations, cut waste, and boost output.

They fuel growth by launching new products, entering fresh markets, or acquiring rivals.

Behind the scenes, they restructure finances, optimize debt, and sharpen the company’s capital strategy.

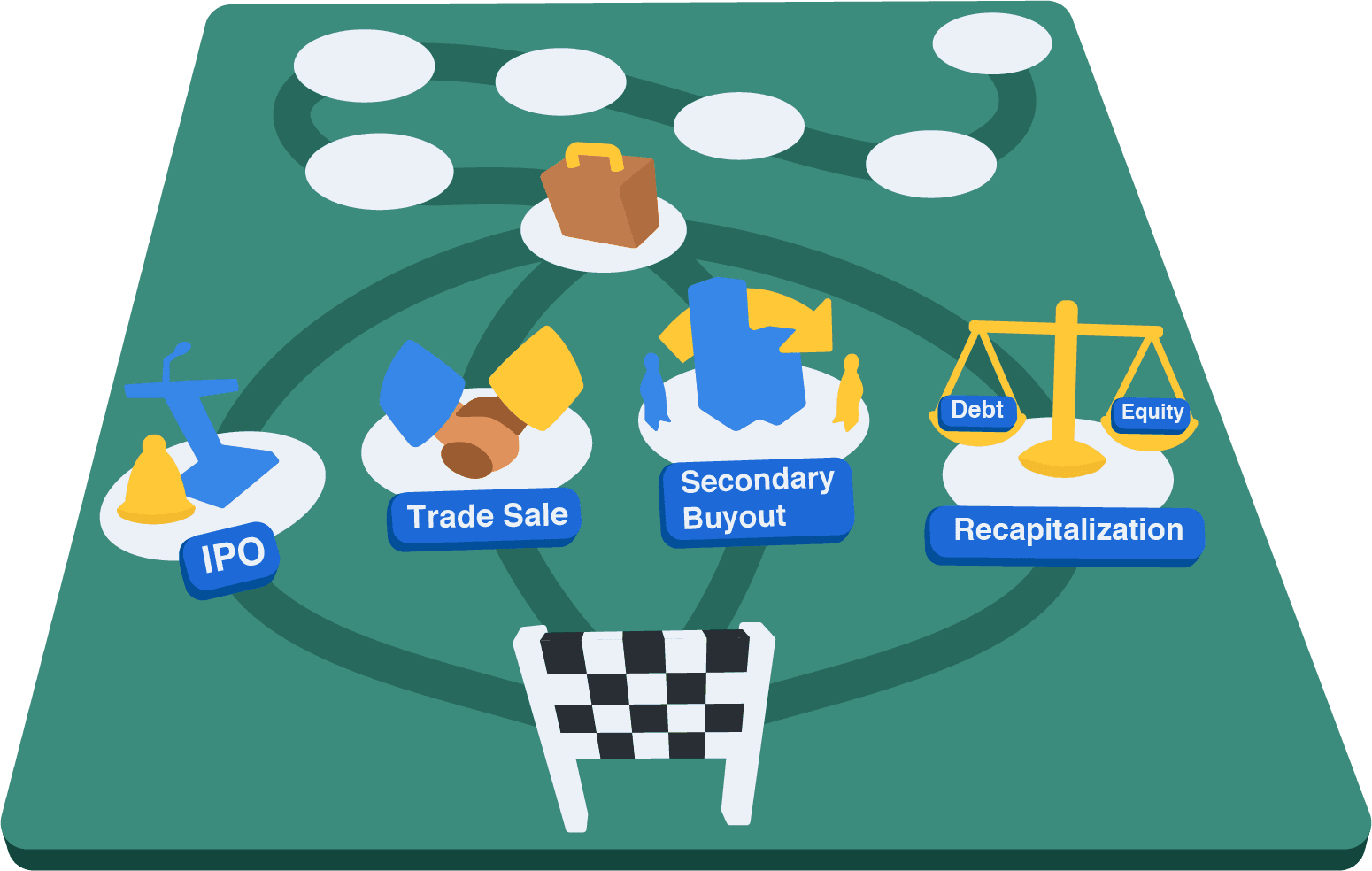

They tie leadership rewards to results, driving accountability and performance. PE firms typically aim for a sale within a few years, focusing on sustainable value creation over short-term gains.