What the Balance Sheet Shows

The balance sheet is a snapshot that captures what the company owns, owes, and what value is left for shareholders after everything is tallied up.

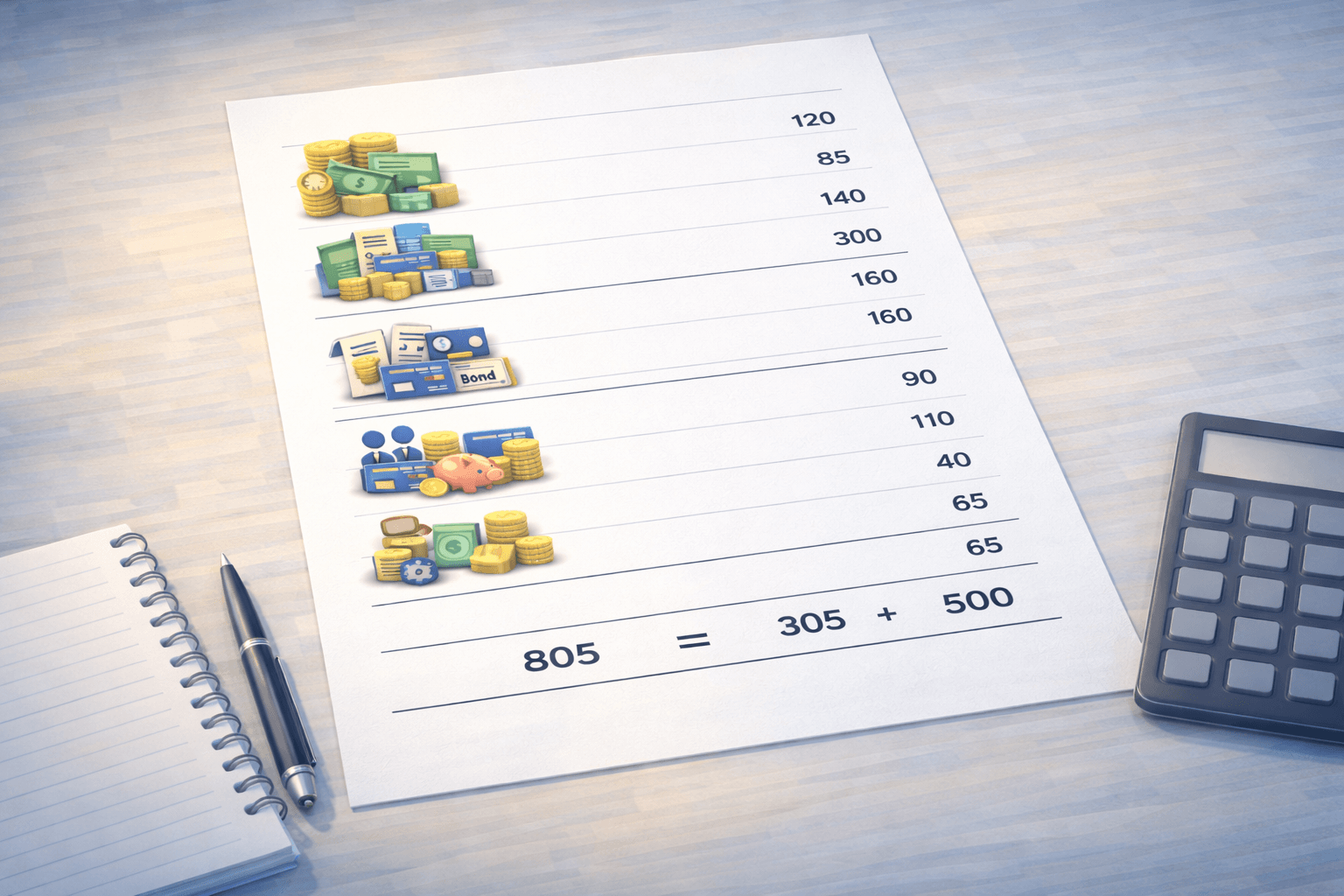

At its core is a simple equation: Assets = Liabilities + Equity.

While the income statement tells the story of a whole quarter or year, the balance sheet hits pause and reveals the financial shape at that moment.

Past choices — borrowing, investments, building up profits — all show up, making it one of the best pieces of evidence for judging a company’s health.