Why Cash Flow Matters

Profit doesn’t always mean cash in the bank.

A company can show strong earnings while running low on money, or report weak profits while cash pours in.

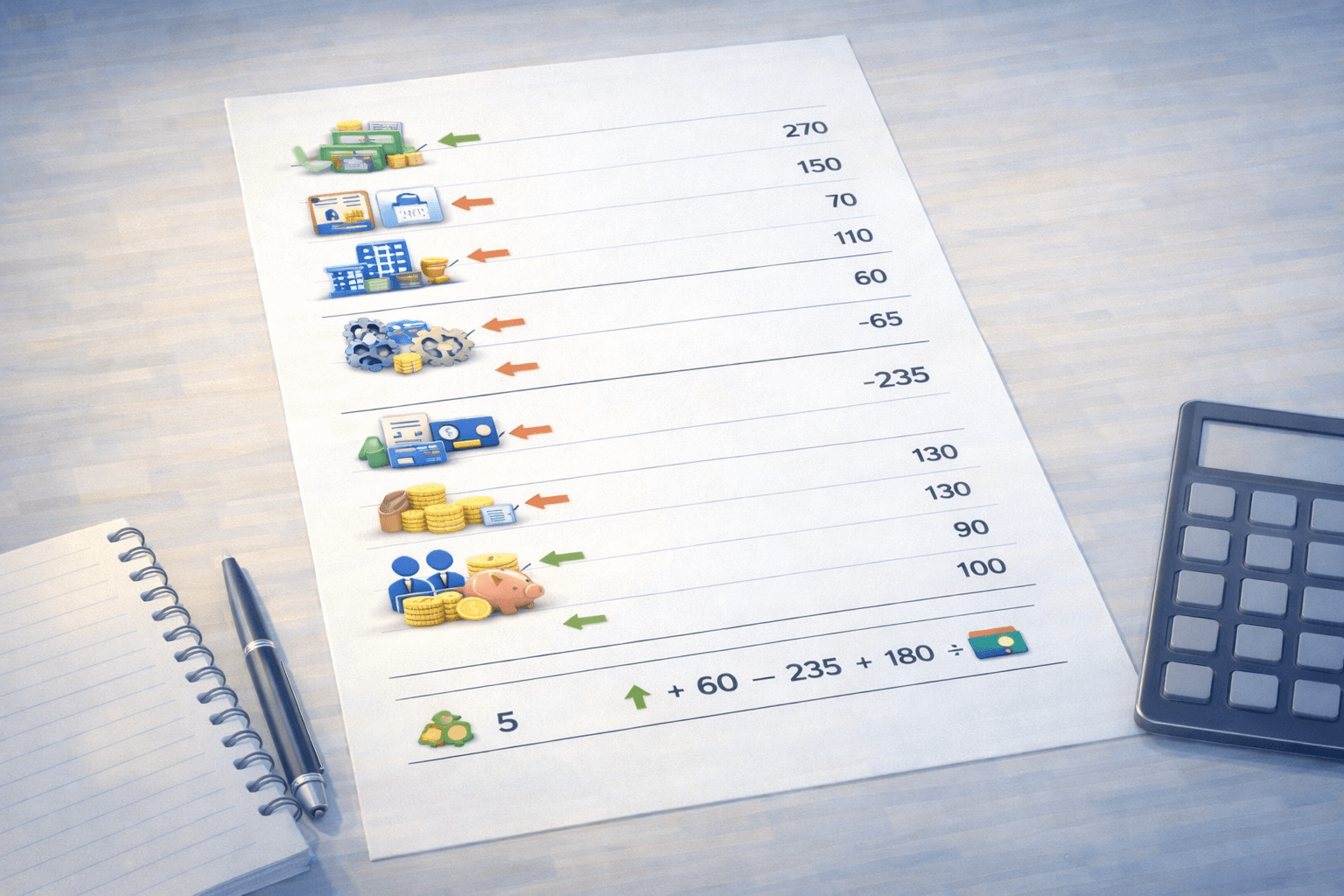

The cash flow statement tracks the actual movement of money in and out of the company.

It reveals whether the business generates cash, whether operational costs and investments consume it, and whether financing fills the gap.

A cash flow statement answers a simple but crucial question: Is the company bringing in real cash or just accounting profits?