How Commodities Are Traded: Spot Market

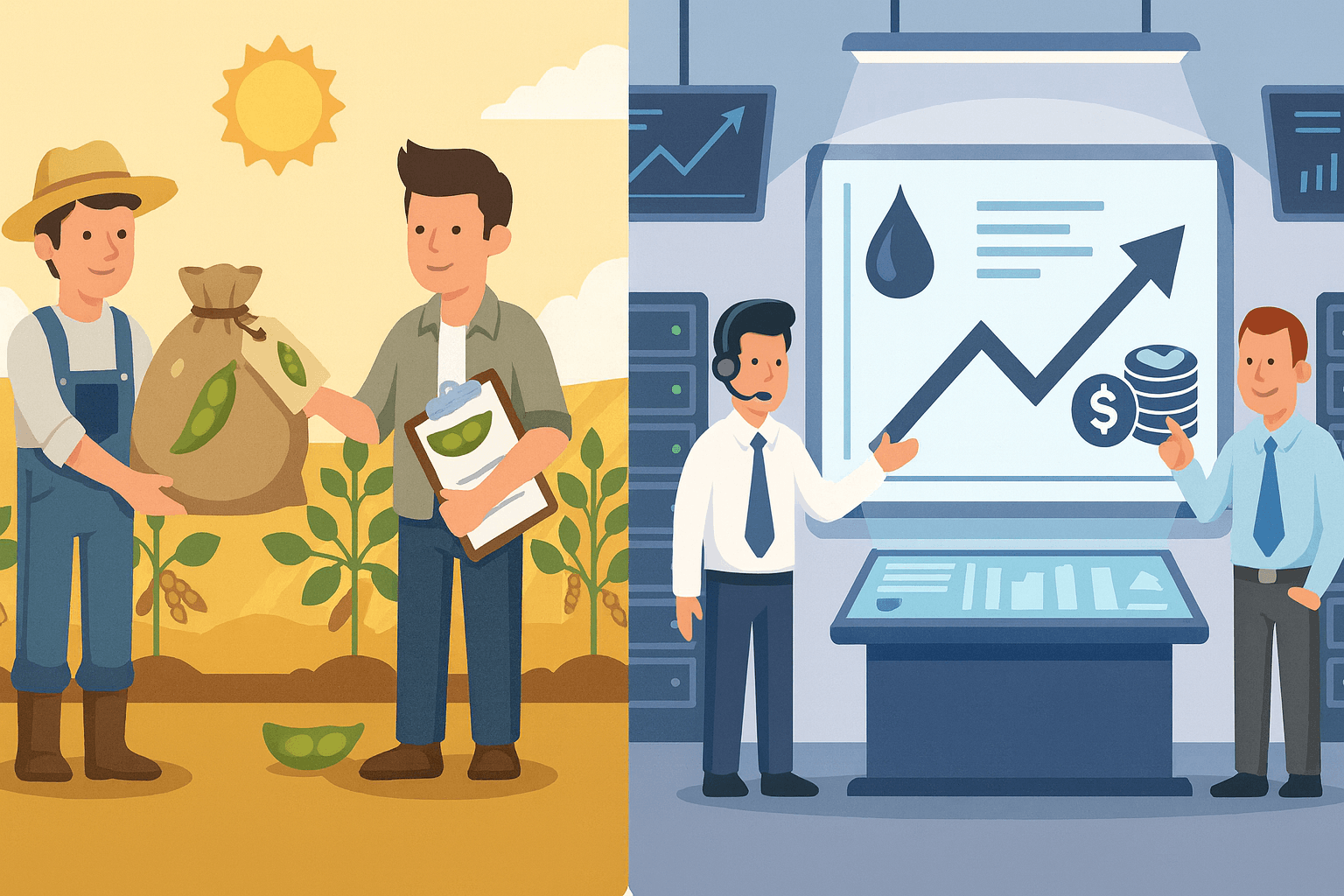

In the spot market, commodities are bought and sold for immediate delivery at current market prices.

Transactions occur "on the spot," reflecting real-time supply and demand.

Spot trading is common for physical commodities where producers and consumers need immediate exchange, such as farmers selling crops or manufacturers purchasing metals.

Prices in the spot market serve as a benchmark for futures contracts and are crucial indicators of current market conditions.