What Makes a Commodity Strategic?

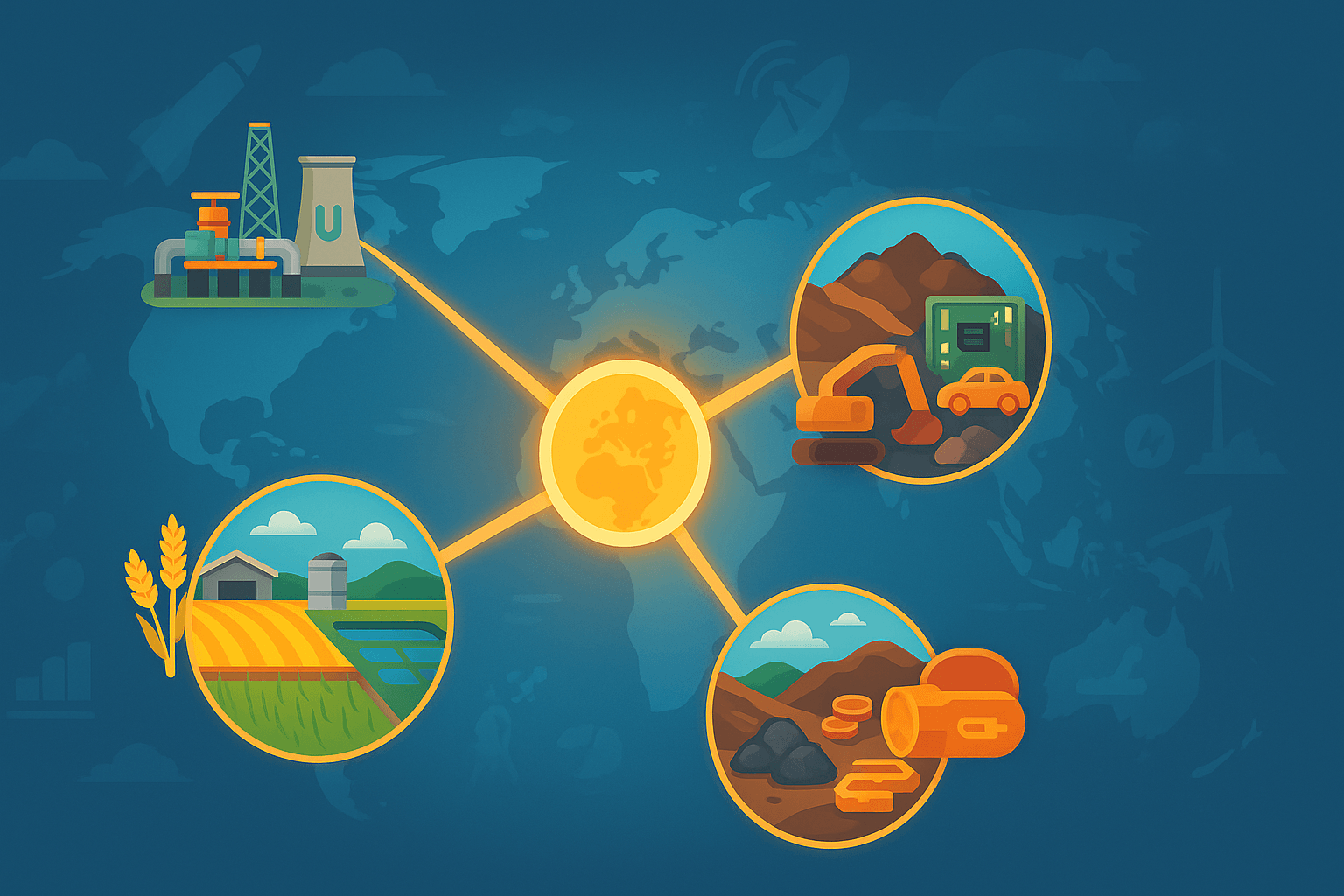

Strategic commodities are essential to national security, economic stability, or technological advantage.

They include energy sources (oil, gas, uranium), food staples (wheat, rice), and technology-critical metals (rare earths, cobalt).

Control over these gives countries leverage in trade negotiations, diplomatic standoffs, and defense.

If a commodity powers missiles, data centers, and electric vehicles, it’s more than just a resource. It’s a strategic asset and a geopolitical tool.