Introduction to Bond Valuation

Bonds are debt instruments providing fixed income over a specified period. Before investing, it's crucial to determine a bond's true value.

Luna, a new investor, and this lesson’s hero, uses the Discounted Cash Flow (DCF) method to evaluate bonds.

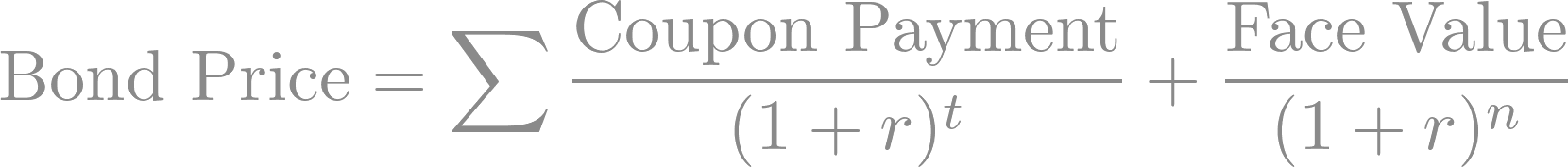

DCF calculates the present value of all expected future cash flows, including coupon payments and face value at maturity.

By discounting these cash flows to today's terms, Luna can assess if a bond is priced appropriately.