Introduction to Corporate Bonds

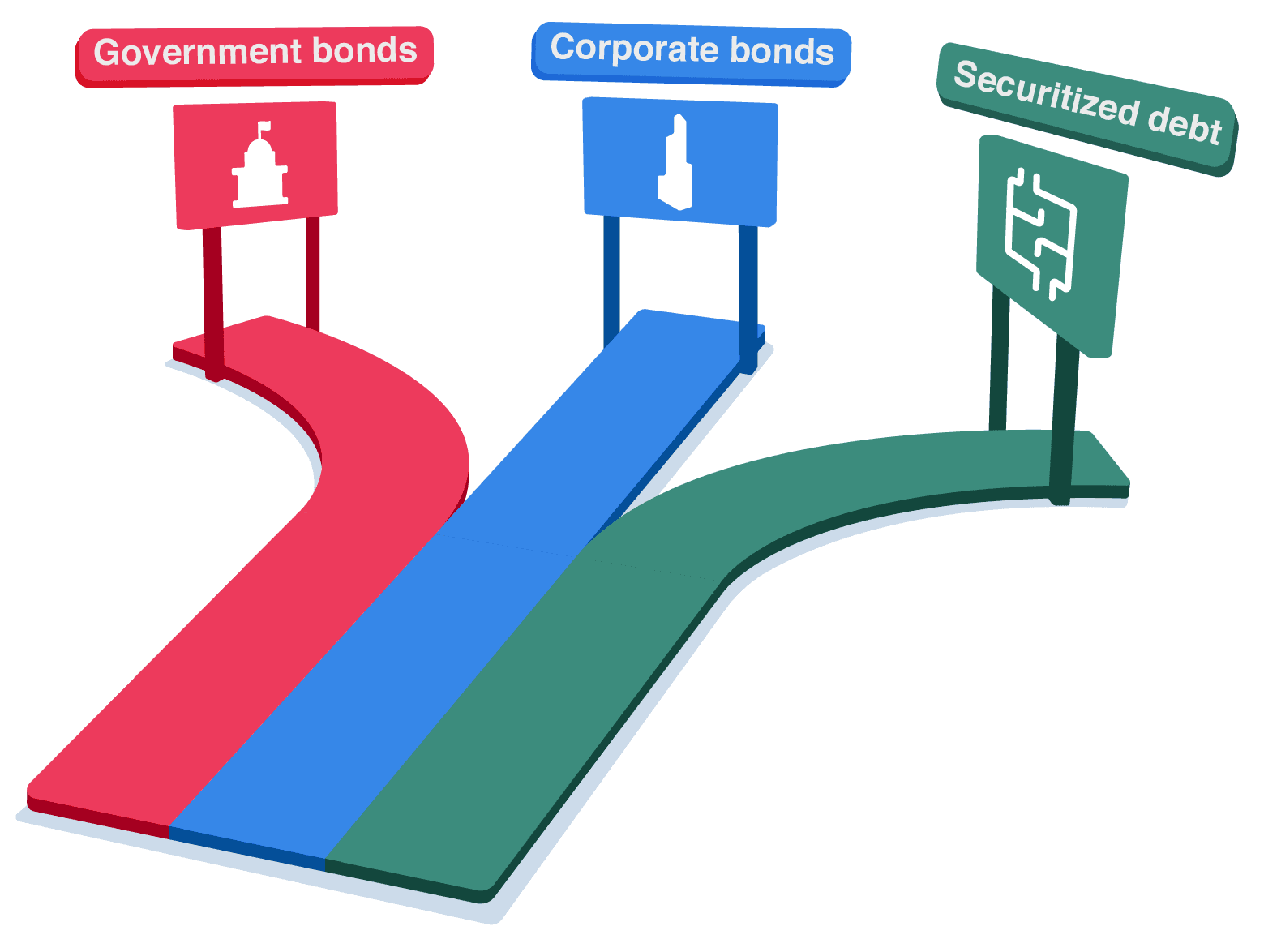

Corporate bonds are issued by companies to raise funds for growth, offering investors income through interest payments.

These bonds generally provide higher returns than government bonds, with varying risk levels based on the company’s financial health.

Carlos, a small business owner, is exploring ways to diversify his investments with bonds that balance income and stability.

In this lesson, we’ll follow Carlos as he learns about corporate bond types to meet his investment goals.