Introduction to Interest Rate Risk

Interest rate risk is the potential for bond values to decline when interest rates rise, impacting returns for investors who hold a range of bonds like Melvin from the previous lesson.

As rates climb, bond prices fall, affecting Melvin’s portfolio value.

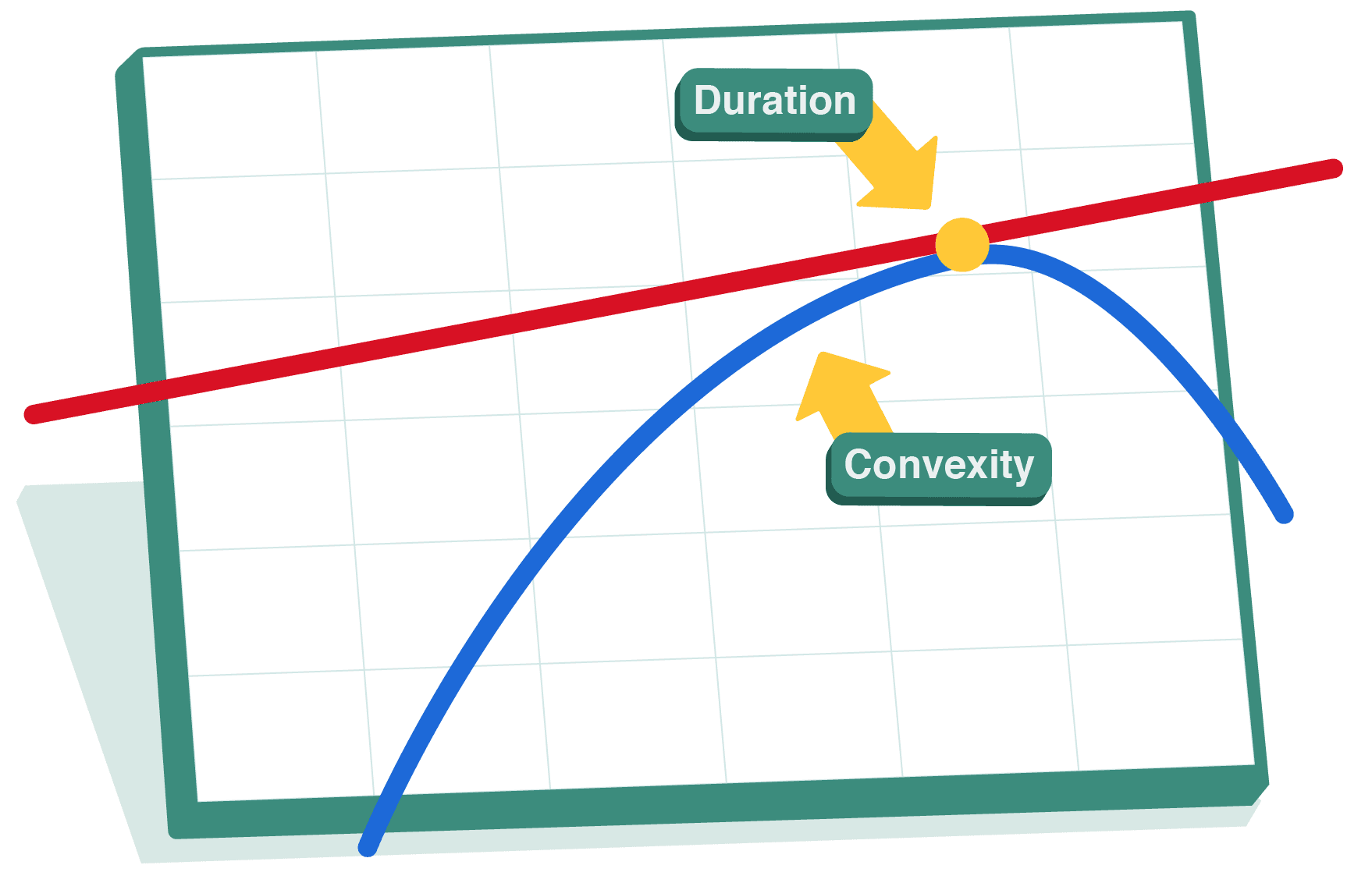

This lesson explores how factors like maturity and coupon rates impact bond sensitivity to rate changes and introduces ways to measure and manage interest rate risk, enabling investors to maintain stability even in volatile markets.