Introduction to Bond Strategies

Bond strategies involve investing in bonds to achieve goals like generating steady income, preserving capital, and managing risk.

Michael leads a university investment club entrusted with $200,000 to fund campus projects.

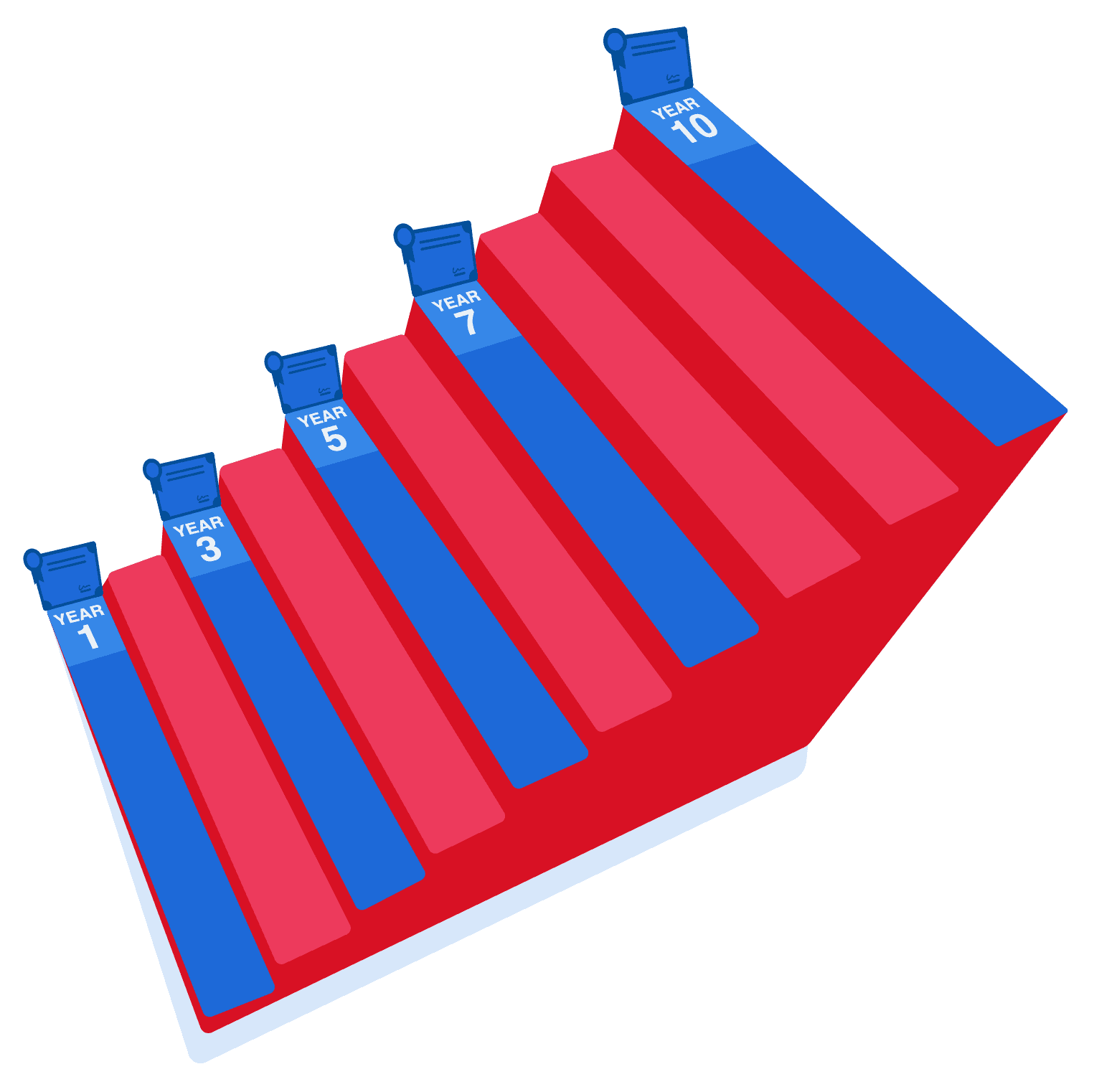

Their primary goals are to finance a new student lounge costing $100,000 in five years, provide annual scholarships, and maintain a reserve for unexpected needs.

They will apply bond investment strategies to meet these objectives and support the university's development.