Bull Call Spread Strategy

Imagine you believe a stock’s price will rise, but only slightly. Instead of buying one expensive option, you might try a strategy known as a bull call spread.

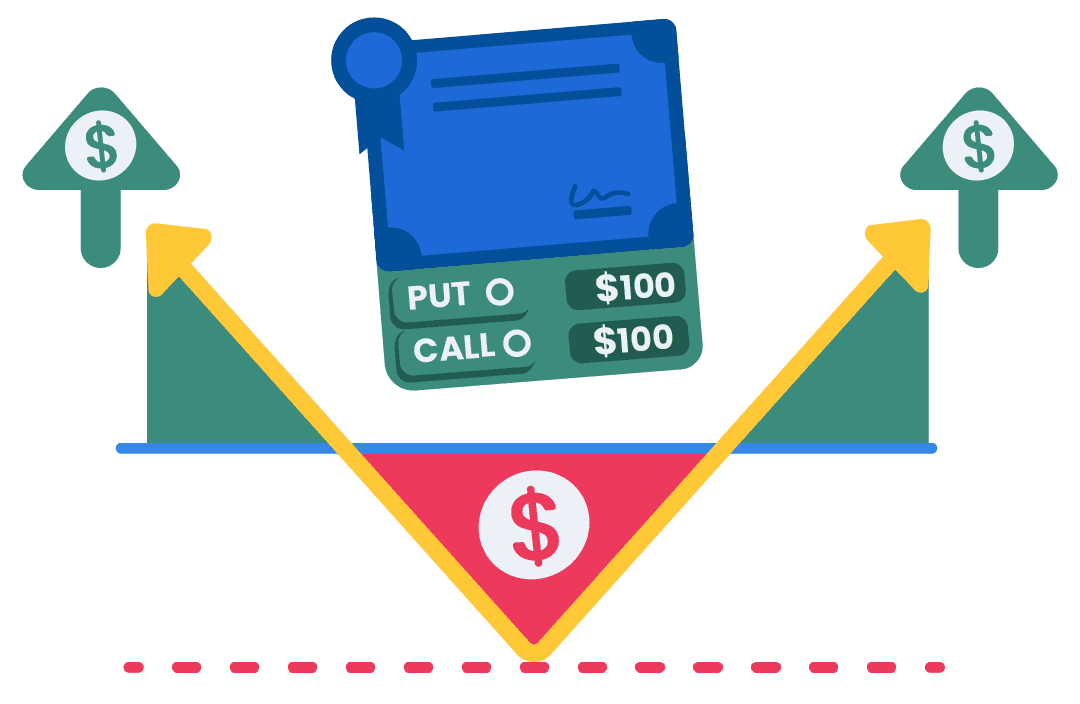

This means you can purchase one call option at a lower strike price and sell another at a higher strike price, both with the same expiration date.

Your maximum profit is the difference between the strike prices minus the net premium paid, while your maximum loss is limited to the net premium.

Also, remember each leg may incur its own commission fee.