Introduction to Put Options

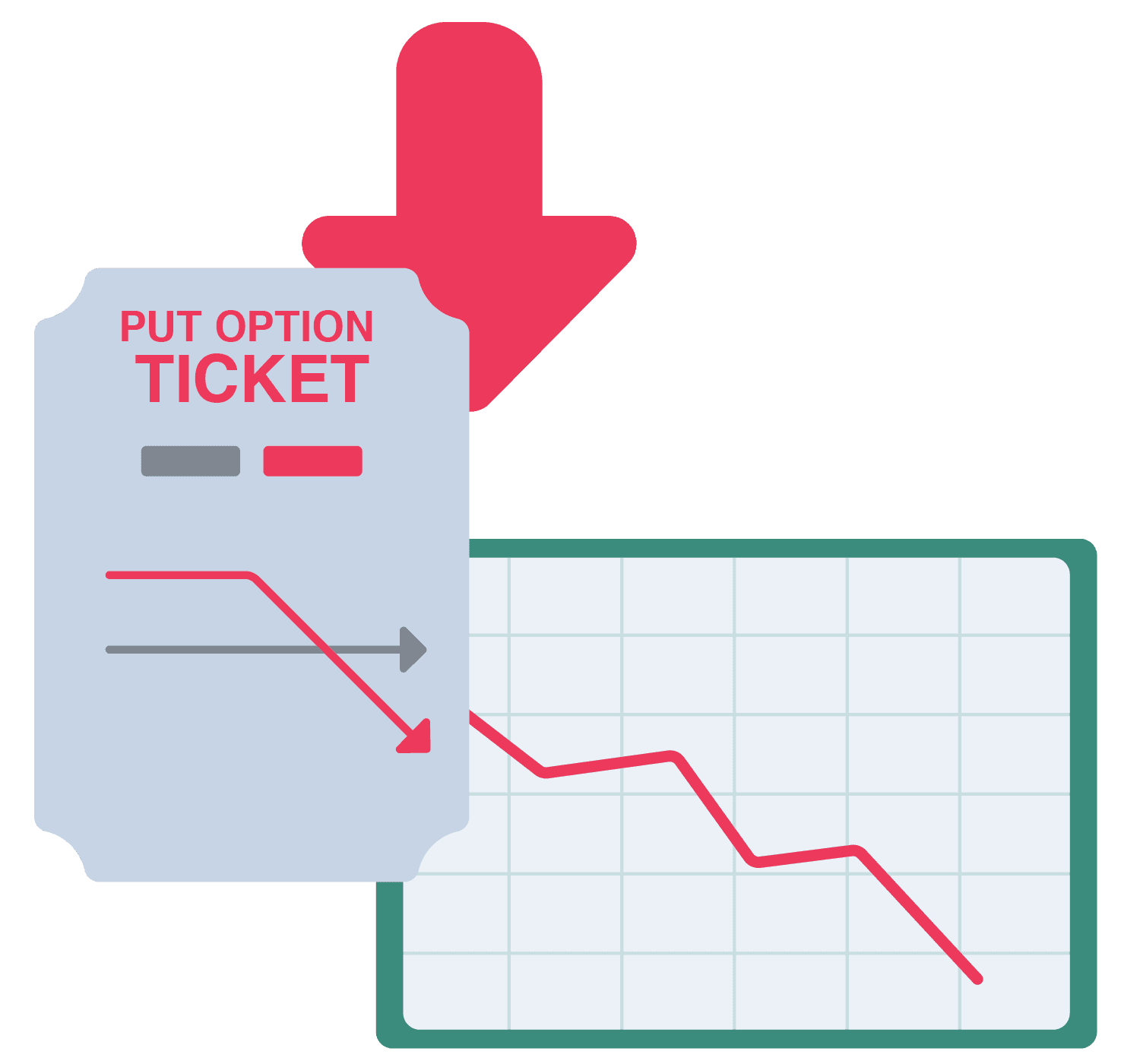

A put option is a financial contract that grants the buyer the right, but not the obligation, to sell an underlying asset, such as a stock, at a predetermined price called the strike price within a specific time frame.

This instrument allows investors to potentially profit from a decline in the asset's price or to protect existing holdings against losses.

After learning about call options, Delilah becomes interested in how put options can help her safeguard her portfolio against market downturns.