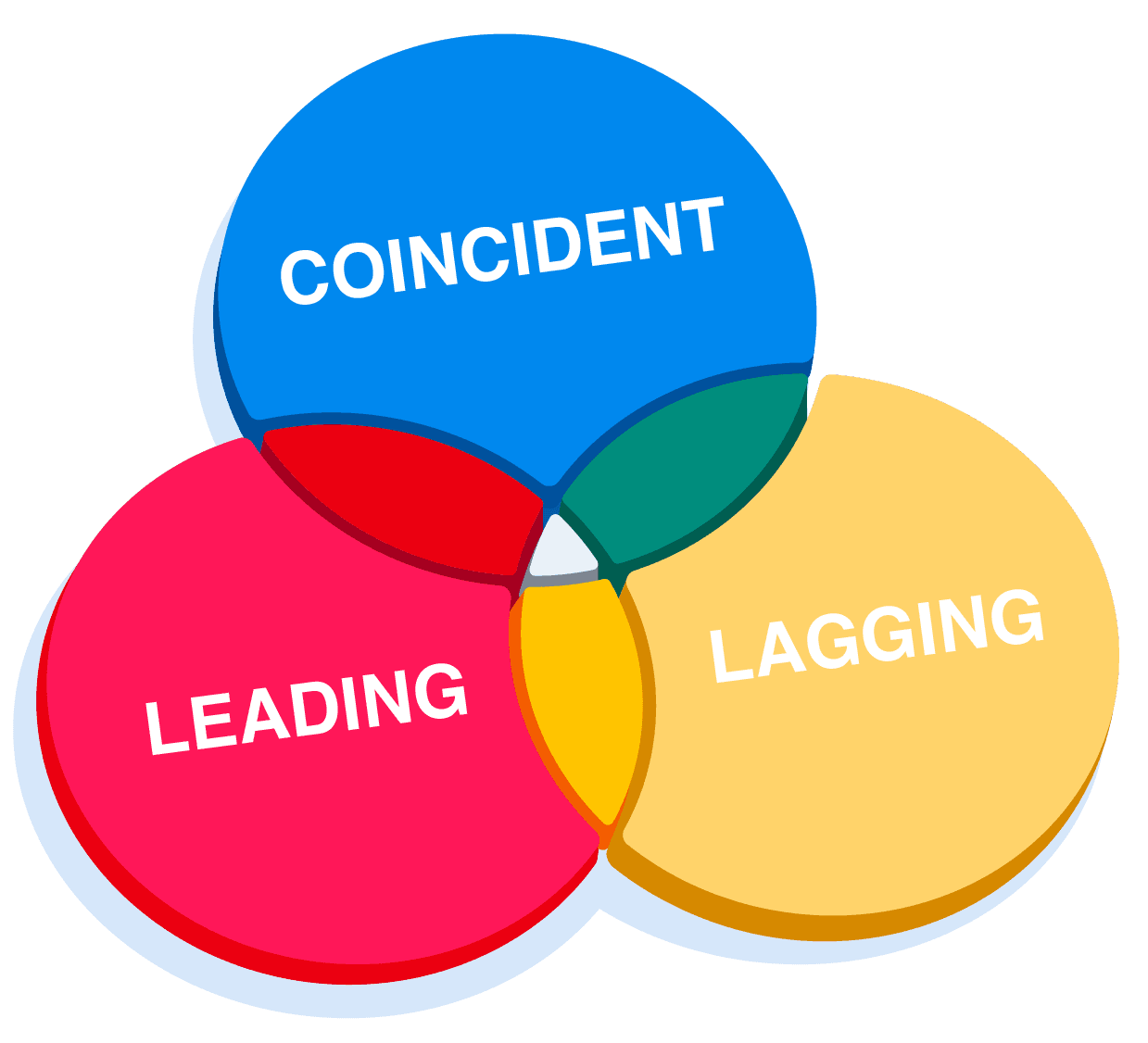

Introduction to Economic Indicators

Economic indicators play a crucial role in evaluating an economy's health and shaping business and investment strategies.

We'll explore these indicators through the story of Elena and Leo from Macronia.

The pandemic hit Elena’s fitness business, FitFlex, and Leo’s career hard.

Elena closed locations and shifted online, while Leo used the time to study investing.

As restrictions ease, they reconnect to plan for what’s ahead and how to make better economic decisions using these indicators.