Chip King

10/16/2025

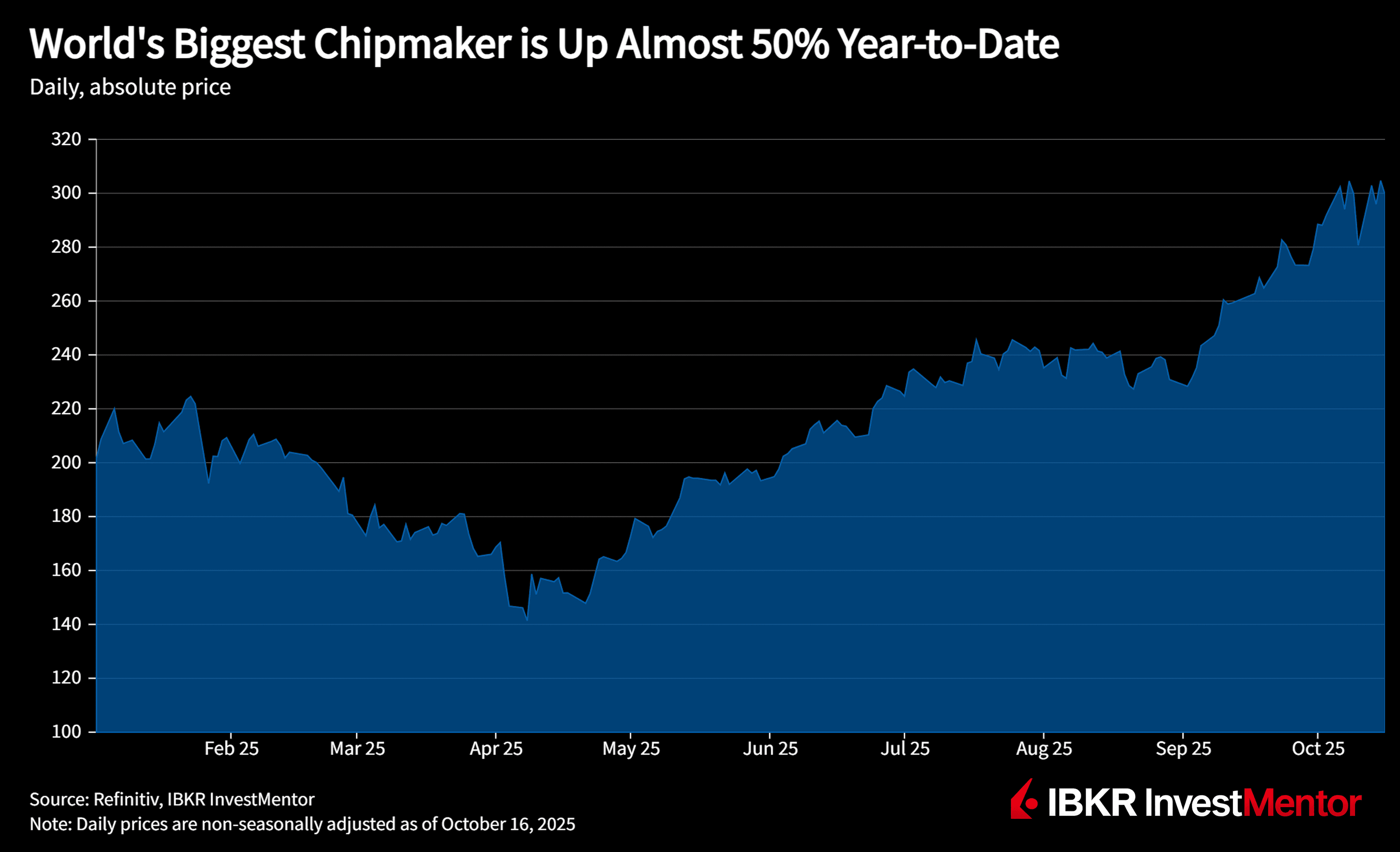

TSMC Shows Chips Are Currency in AI Boom

The world’s biggest chipmaker just smashed earnings forecasts, and not by selling GPUs or launching chatbots. Taiwan Semiconductor Manufacturing Co. (TSMC) is quietly powering the entire AI boom, making chips for everyone from Nvidia to Apple.

With huge hype around AI technology pushing up share prices, TSMC’s results show there’s real money to be made in silicon.

Blockbuster Earnings for the Chipmaker

- TSMC’s third quarter profit jumped 39% year-on-year, beating estimates and hitting a new record.

- Revenue also jumped by almost a third.

- TSMC lifted its full year revenue growth forecast. This was just three months after the latest guidance hike.

- The growth is coming from the smallest, most advanced chips, the brains behind today’s AI accelerators and high-end phones.

The Company Behind the Curtain

While Nvidia, the most valuable company on Earth, grabs the headlines, it’s TSMC that builds Nvidia’s chips.

Without TSMC’s fabrication plants or fabs, those GPUs are just design concepts.

Because everyone needs chips, TSMC has become one of the most critical links in global tech manufacturing.

So, What’s a Fab?

A fab (short for fabrication plant) is where microchips are physically made. It’s an ultra-clean, billion-dollar facility filled with machines that etch microscopic circuits onto silicon wafers.

- Chip designers (like Nvidia, Apple or AMD) dream up the chip.

- Fabs (TSMC) actually manufacture it.

- Toolmakers (ASML) build intricate lithography machines used by TSMC

In short: designers imagine, fabs make.

Chip manufacturing is incredibly complicated and hard to replicate. That’s why whoever controls the infrastructure behind it, controls the future of computing.

Hot Chips, Cold Risks

- Geopolitics: US–China trade and tech tensions put Taiwanese chipmaker in a difficult spot. TSMC has been expanding production to Arizona and Japan to hedge against that.

- Home risk: Based in Taiwan, TSMC, always risks being swept away by a conflict in the region

- Over-investment risk: If AI demand cools, new fabs could sit half-empty.

- Customer concentration: Relies on big clients like Apple and Nvidia

- Key supplier risk: Dutch ASML has unique capabilities in lithography that TSMC needs

What This Means for You

Earnings from a single company can often tell a wider story. TSMC is a barometer for the whole AI economy.

- The AI trend isn’t just about chatbots; it’s about hardware infrastructure.

- When demand for chips rises, suppliers, equipment makers, and designers all benefit.

- But beware: sky-high expectations are priced in. Even a small slowdown could send shares tumbling in the whole sector.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.