US Jobs

12/16/2025

Another Soft Month

Total nonfarm payrolls rose by just 64,000 in November and have shown “little net change” since April. That’s a very different backdrop from the rapid job gains we saw coming out of the pandemic. Hiring is still positive, but we’re much closer to stall speed than to a booming labor market.

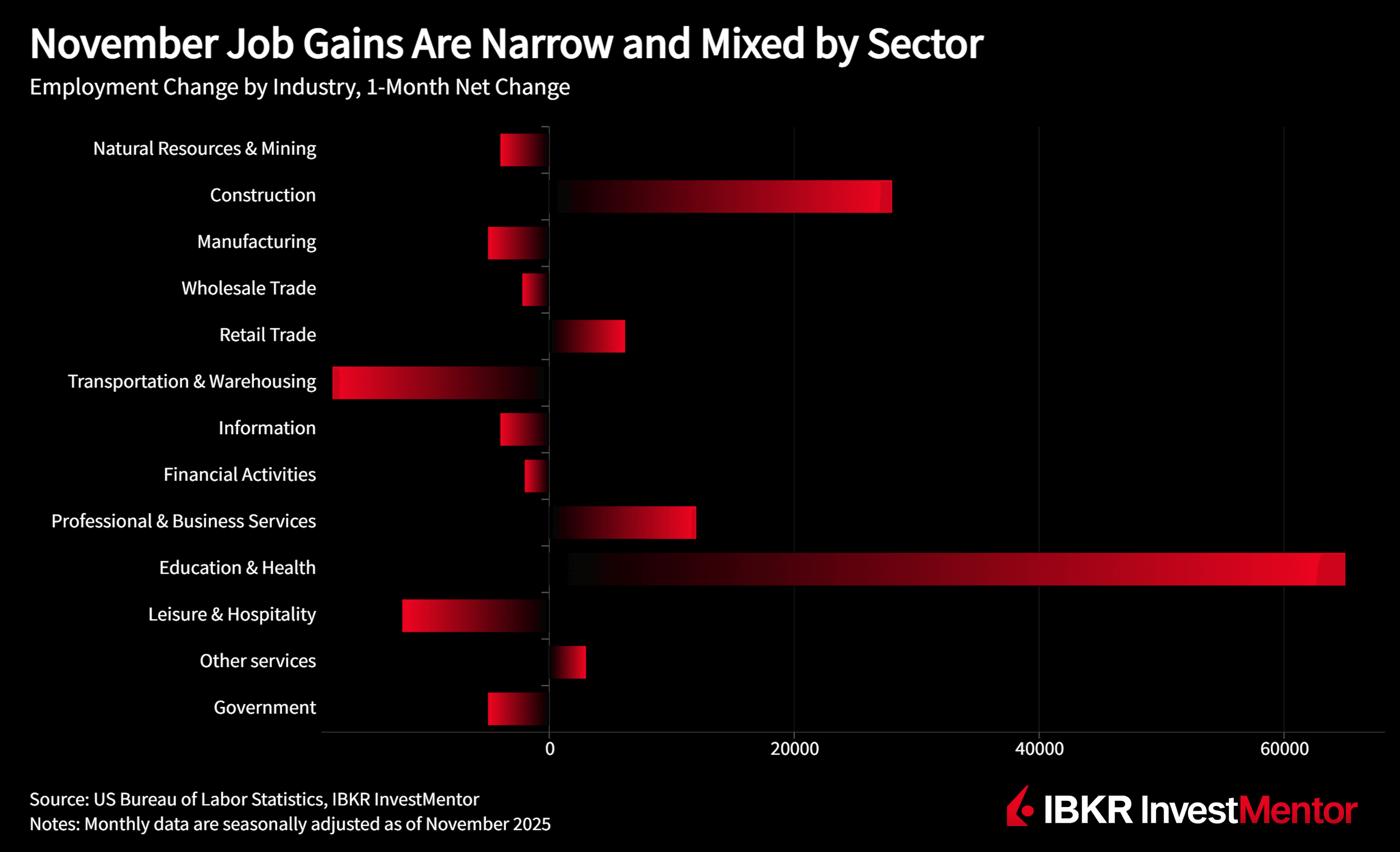

The gains that did show up were narrow:

- Health care: +46,000 (still one of the most reliable growth engines)

- Construction: +28,000, led by nonresidential specialty trade contractors

- Social assistance: +18,000, mostly in individual and family services

Offsetting that, we saw:

- Transportation & warehousing: -18,000, with couriers and messengers taking the hit

- Federal government: -6,000 in November, after a huge drop of 162,000 in October tied to deferred resignations coming off payrolls

Higher Than a Year Ago, Slack Building Under the Surface

The unemployment rate held at 4.6%, little changed from September, but up from 4.2% a year ago. That translates to 7.8 million people unemployed, versus 7.1 million last November.

Under the surface:

- The number of people jobless less than 5 weeks rose by 316,000 to 2.5 million, a sign of more recent layoffs and job loss.

- Long-term unemployment (27+ weeks) is steady at 1.9 million, about 24.3% of all unemployed, so the issue now is more about new softening than entrenched joblessness.

- The labor force participation rate (62.5%) and employment-population ratio (59.6%) are essentially unchanged on the month and over the year, no big new wave of people coming back in, but also no sharp exit.

One number that stands out: people working part time for economic reasons jumped by 909,000 to 5.5 million. These are workers who want full-time jobs but can’t get the hours. That’s often an early sign that employers are trimming at the margins, cutting hours before cutting heads.

Pressure Easing, Not Surging

Average hourly earnings for all private workers rose just 0.1% on the month and 3.5% over the past year. For production and nonsupervisory workers, pay was a bit stronger (+0.3% m/m), but we’re still well below the peak wage growth seen earlier in the cycle.

The average workweek ticked up slightly to 34.3 hours, but manufacturing hours and overtime were basically unchanged. Taken together with the rise in involuntary part-time work, this still looks like a labor market where bargaining power is drifting back toward employers.

Shutdown Noise, but the Trend is Still Softer

The report is also complicated by the federal government shutdown that ran from October 1 to November 12:

- No October jobs report was published, and November data collection/processing were delayed.

- Federal workers on furlough were still counted as employed in the establishment survey if they were paid for the reference week, which helps explain some of the unusual federal employment swings.

Even allowing for that noise, the broader pattern is clear: job growth has downshifted, unemployment is higher than a year ago, and under-the-surface slack (short-term unemployed, involuntary part-time) is building gradually.

How to Read It

For policymakers and markets, this print supports the narrative of a slow-cooling labor market rather than a sudden break:

- Not strong enough to justify aggressive tightening.

- Not weak enough to scream recession, but clearly moving in that direction compared with 2023.

For investors, the takeaway is that the “late-cycle” feel of the economy is now showing up more plainly in the data: narrow sectoral job gains, softer payroll growth, still-positive but moderating wages, and more people settling for fewer hours than they’d like.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.