US at a Glance

1/9/2026

A Steady Jobless Rate, But Workers Feel the Strain

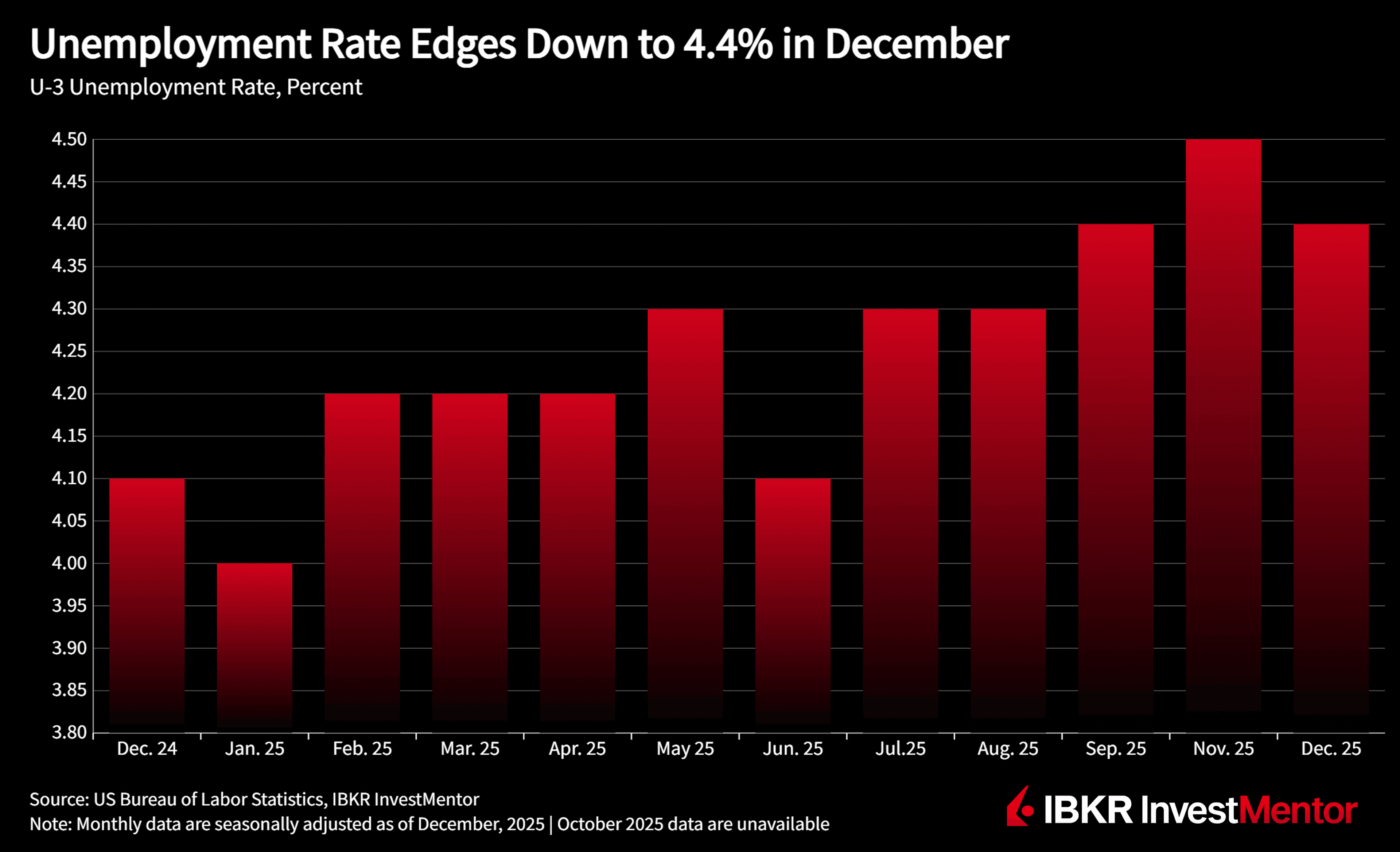

December’s data tell a story of a labor market that looks stable on the surface but is carrying more pressure underneath. The unemployment rate improved to 4.4%, even after seasonal revisions lifted earlier readings, and payrolls rose modestly by 50,000 jobs. On paper, that’s not a weak market. But when you line it up alongside underemployment, long-term joblessness, wages, and sentiment, you see an economy that feels a lot tougher to households than the headline suggests.

Headline Unemployment vs. Lived Experience

From the household survey:

- Unemployment rate: 4.4%

- Unemployed people: 7.5 million

Revisions to past data mean this 4.4% reading now represents a clear improvement from where the jobless rate had been tracking earlier in 2025. By age and gender, unemployment for adult men and women sits at 3.9%, and 15.7% for teenagers, with little change over the month.

But several “quality-of-labor-market” indicators are moving in a more worrying direction:

- Long-term unemployed (27+ weeks): 1.9 million, flat in December but up 397,000 over the year, now 26% of all unemployed

- Employed part time for economic reasons: 5.3 million, little changed on the month but up 980,000 over the year

- People not in the labor force who want a job: 6.2 million, flat in December but up 684,000 over the year

Labor force participation (62.4%) and the employment–population ratio (59.7%) have barely moved all year.

Slow Gains, Narrow Strength

On the establishment side:

- Nonfarm payrolls: +50,000 in December

- Total 2025 job gains: +584,000 (about 49,000 per month) vs 2.0 million in 2024 (168,000 per month)

The gains are narrow and familiar:

- Food services and drinking places: +27,000

- Health care: +21,000 (including +16,000 in hospitals)

- Social assistance: +17,000, driven by individual and family services

Those sectors speak to steady demand for services and care, not a broad hiring wave.

Retail trade lost 25,000 jobs, with declines at warehouse clubs/supercenters and food & beverage retailers, partially offset by gains at electronics and appliance stores. Federal government employment was flat on the month but down 277,000 (9.2%) since January, as prior expansions unwind.

Revisions added a sour note:

- October payrolls cut from –105,000 to –173,000

- November trimmed from +64,000 to +56,000

Together, that’s 76,000 fewer jobs than first reported, reinforcing the sense that momentum has already been fading for a while.

Wages vs. Inflation Expectations

Pay is still rising, but not enough for workers to feel relaxed about their finances:

- Average hourly earnings (AHE, all employees):

- +0.3% in December

- +3.8% over the past year

- AHE for production and nonsupervisory workers:

- Essentially unchanged at $31.76 (+3 cents)

- Average workweek:

- Down to 34.2 hours (–0.1 hour), with manufacturing at 39.9 hours and overtime steady at 2.9 hours

So, households see solid wage growth on paper, but two things blunt the comfort:

- Some of that income growth is offset by shorter hours, which quietly reduces total paychecks.

- Inflation expectations remain high enough that real purchasing power still feels under pressure.

The latest consumer sentiment data underline that:

- Sentiment rose for the second month in a row and is now at its highest level since September 2025.

- The improvement came from lower-income consumers, while sentiment fell among higher-income households.

- Even so, overall sentiment is still nearly 25% below last January’s level.

A Labor Market Under Quiet Pressure

Put all of this together and the narrative isn’t “everything is fine” or “everything is breaking.” It’s more nuanced:

- The headline jobless rate is improving, and layoffs are not surging.

- But job gains are modest, recent months were revised down, and more workers are stuck underemployed or unemployed for longer.

- Wages are rising, but not quite enough to outrun how people feel about prices and job security.

- Sentiment is off the lows, especially for lower-income households, but still dramatically weaker than a year ago.

It’s a labor market under quiet pressure: still functioning, still creating jobs, but delivering a day-to-day reality that feels tight for many households. For policymakers, that mix complicates the calculus—on one hand, there’s no clear collapse to force immediate action; on the other, there’s little sign that workers feel like they’re back in a genuinely comfortable spot.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.