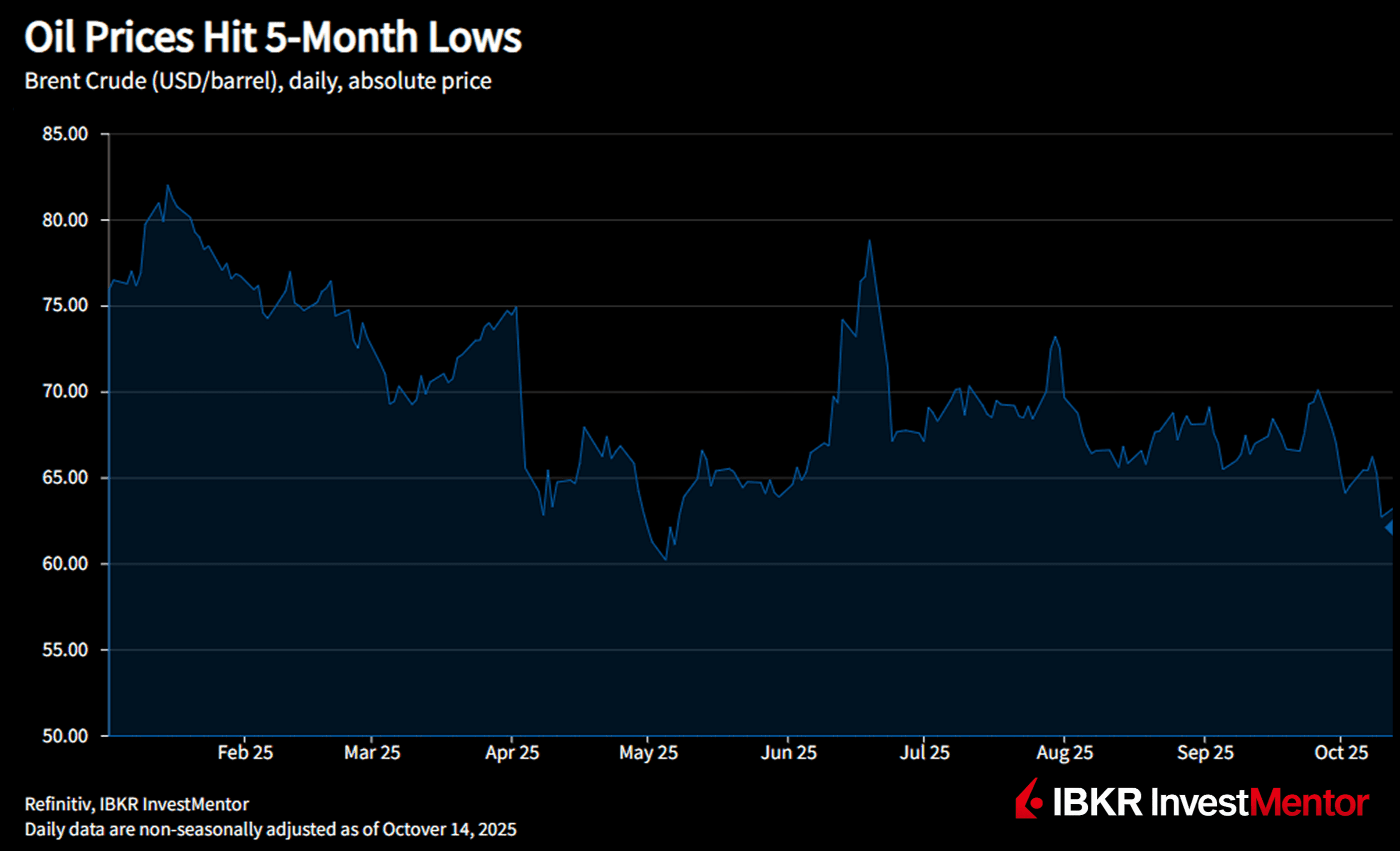

Crude Slide

10/14/2025

Headline: Oil prices Are Sliding — Here’s Why

Oil prices have fallen to their lowest point in five months.

Three big forces are driving the slide:

- More tariffs and trade feuds

- A ceasefire in the Middle East

- Too much oil in the market

Two main crude oil benchmarks hit their lowest levels since May on Tuesday: Brent crude at about $62 per barrel and WTI at $58.

At the pump, a US customer is paying on average just $3.11 per gallon, driven by weak local demand and global supply glut.

The Oil Glut Is Real

The International Energy Agency pushed oil prices down on Tuesday as it released its monthly oil report.

IEA said:

- The world oil market faces a surplus throughout 2026, as much as 4 million barrels per day

- OPEC+ producers and rivals are likely to raise output

- Demand to remain sluggish

OPEC+, a group of major oil producers led by Saudi Arabia, increased production slightly in October. This was the latest round of production ramp-ups that started earlier this year. Investors are betting OPEC countries and allies will struggle to rein in production.

Trade Tensions Ripple to Oil Markets

Fresh threats between the US and China on trade have hit global markets across asset classes. Oil is one of them.

- Tit-for-tat port fees came into effect on Tuesday: China charges US vessels using Chinese harbors and vice versa. This impacts oil tankers too.

- China also announced more restrictions on rare earth metal exports. The US retaliated, threatening 100% additional tariffs on Chinese goods.

While port fees could make transporting oil more expensive, the overall impact of trade tensions is likely to slow global trade, resulting in less demand for oil and thus lower prices.

Ceasefire Reduces Risks on Supply Routes

As a ceasefire took place in Gaza, geopolitical tensions eased in the region.

While this is great news for the peace process, it results in lower oil prices as supply routes become less risky. Generally, when the world is calmer, oil gets cheaper.

Traders who were holding oil futures to hedge against conflict may now be unwinding at least some of those bets.

Volatility Triggers to Look Out For

- A further escalation of the trade war could hit demand forecasts

- Large stock builds shifting to storage hubs could add to the oil glut

- Geopolitical tensions could flare up again in the Middle East and reintroduce a risk premium

- Any further moves by OPEC+, either to cut or increase production, will always move the oil market

- US shale oil producers have warned that persistent low prices may lead to a drop in US production

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.