Oil Ban

10/23/2025

Sanctions Hit Russia’s Energy Sector

The US just sanctioned Rosneft and Lukoil, Russia’s two biggest oil firms, in an effort to force a ceasefire in Ukraine.

Why this matters: Rosneft and Lukoil account for over 5% of all global output. Sanctions also impact refineries that buy Russian oil, such as those in China and India.

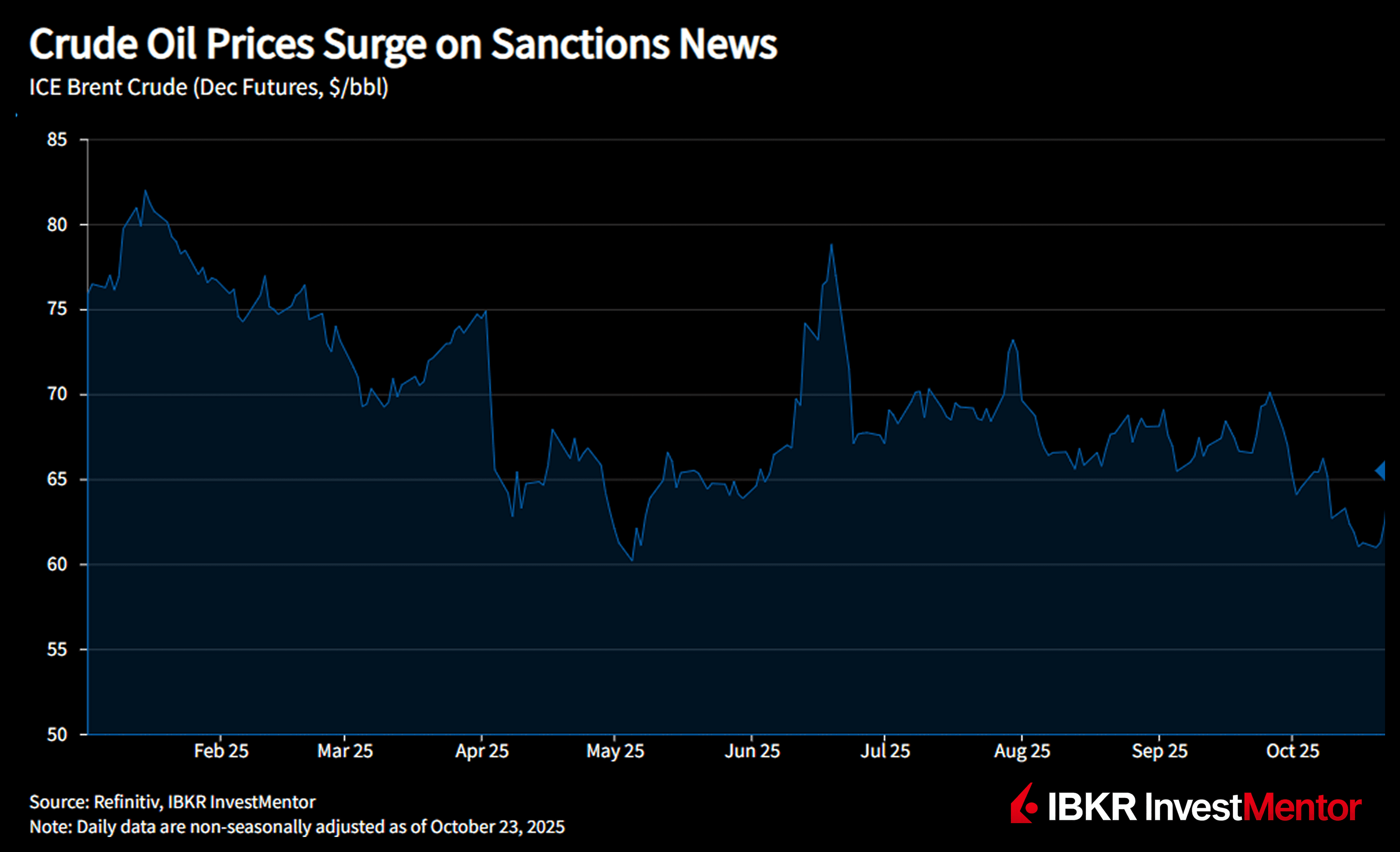

Reaction: Global oil prices shot up on worries that the global supply would be disrupted.

EU Targets Russian LNG

The EU revealed new sanctions, including a phased ban on imports of Russian liquified natural gas (LNG) by 2027.

The EU also expanded its ban on Russia-linked tankers, bringing the total “shadow fleet” to 558 vessels.

Together with fresh US sanctions, it’s a coordinated push to choke off Russia’s oil and gas revenue — down 21% this year but still a quarter of its budget.

Oil Jumps on Supply Fears

With supply routes under pressure, markets are bracing for ripple effects across the energy chain.

• Oil price benchmarks Brent and WTI crude jumped more than 5%

• U.S. fuel stockpiles fell unexpectedly, adding upward pressure

But the rally may be short-lived — the International Energy Agency has warned of a major supply glut in 2026, and further OPEC+ production increases could add downward pressure.

Backwardation vs. Contango

Following the news, Brent crude prices are now in backwardation — the front-month contract is trading nearly $2 above the six-month price.

Oil futures show where traders think prices are headed:

• Backwardation means near-term contracts cost more than future ones — often a sign of tight supply or geopolitical risk

• Contango is the opposite: future contracts for later delivery trade higher, usually because inventories are full or demand is weak

Russia Risks Losing Key Customers

India has become Russia’s biggest buyer of discounted seaborne oil since the previous sanctions cut off traditional markets.

Now, major Indian refiners like Reliance may halt purchases to avoid US penalties. If India pulls back, Russia will need new buyers fast — likely at even steeper discounts.

The US Treasury has set November 21 as the deadline for companies to wind down Russian oil deals.

How Sanctions Move Markets

Sanctions are a blunt tool — potentially powerful, but unpredictable, and markets hate uncertainty.

Here’s how different asset classes may react to sanctions:

• Equities: Shares in sanctioned firms or sectors often plunge.

• Sovereign bonds: Sanctioned government’s bond yields may spike, and they may even face a default

• Commodities: Targeting specific commodities like oil, gas or metals can disrupt global supply chains and lead to price spikes.

• Currencies: Targeted nations often see sharp depreciation.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.