Vanke Woes

12/15/2025

China's Property Crunch Enters New Territory

Property Developer China Vanke is scrambling to win bondholder approval to delay repayment of a 2 billion‑yuan bond ($283 million) that just came due. Its first request for a one‑year extension flopped, raising the risk of default unless investors back a revised plan in a second vote on Dec 22.

In China’s real estate sector, companies that have had their repayment schedule extended often end up defaulting later anyway — making bondholders wary. But rejecting the deal could spark a wider contagion amongst property developers.

Once seen as one of the strongest Chinese developers, Vanke’s struggle is a wake‑up call: even the “safe” names aren’t safe anymore.

State‑Backing Questioned by Investors

About 30% of Vanke is owned by Shenzhen Metro, the operator of Shenzhen’s subway system. Shenzhen Metro, in turn, is owned by the local government of Shenzhen.

That link led investors to assume Vanke had state support and would be shielded from the liquidity crunch that sank huge property group Evergrande (dissolved last year) and pushed another big rival, Country Garden, into default and restructuring.

But with land sale revenues sinking since 2021, local governments are heavily indebted and not best equipped to do big bailouts. Meanwhile, the central government has been reluctant to step in to help property giants.

Bonds and Shares Flash Warning Signs

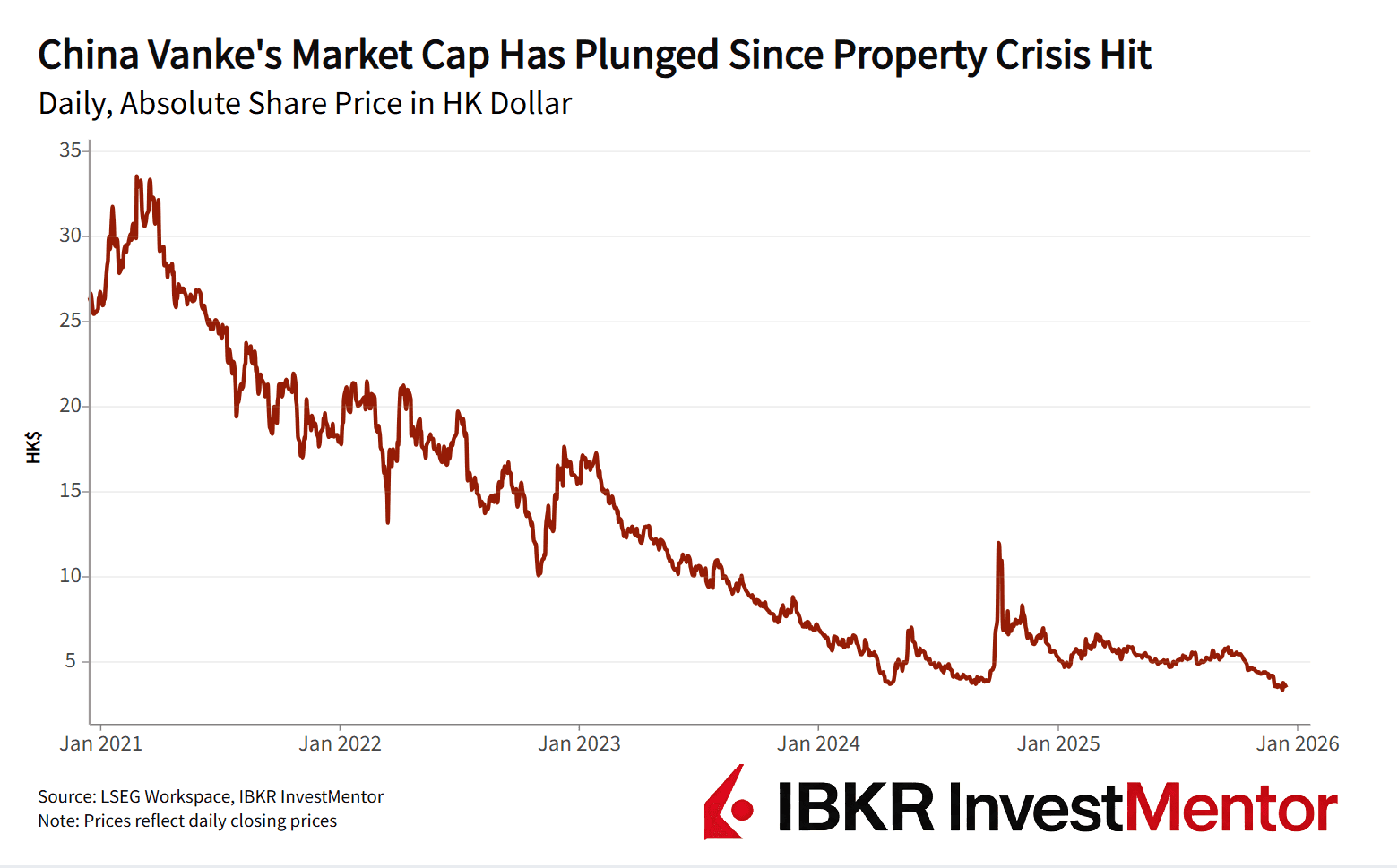

The stress is showing up in prices. Another one of Vanke's yuan bonds, due in three years, collapsed 26% in a single day, with company shares sliding in Hong Kong as much as 5% on Monday.

Vanke has lost more than 85% of its value since the property market started tumbling in 2021.

Some creditors may agree to delay the repayment if Vanke offers sweeteners like stronger guarantees or partial early payback. But the hurdle is high: at least 90% of bondholders must vote yes.

Home Prices Continue to Slide

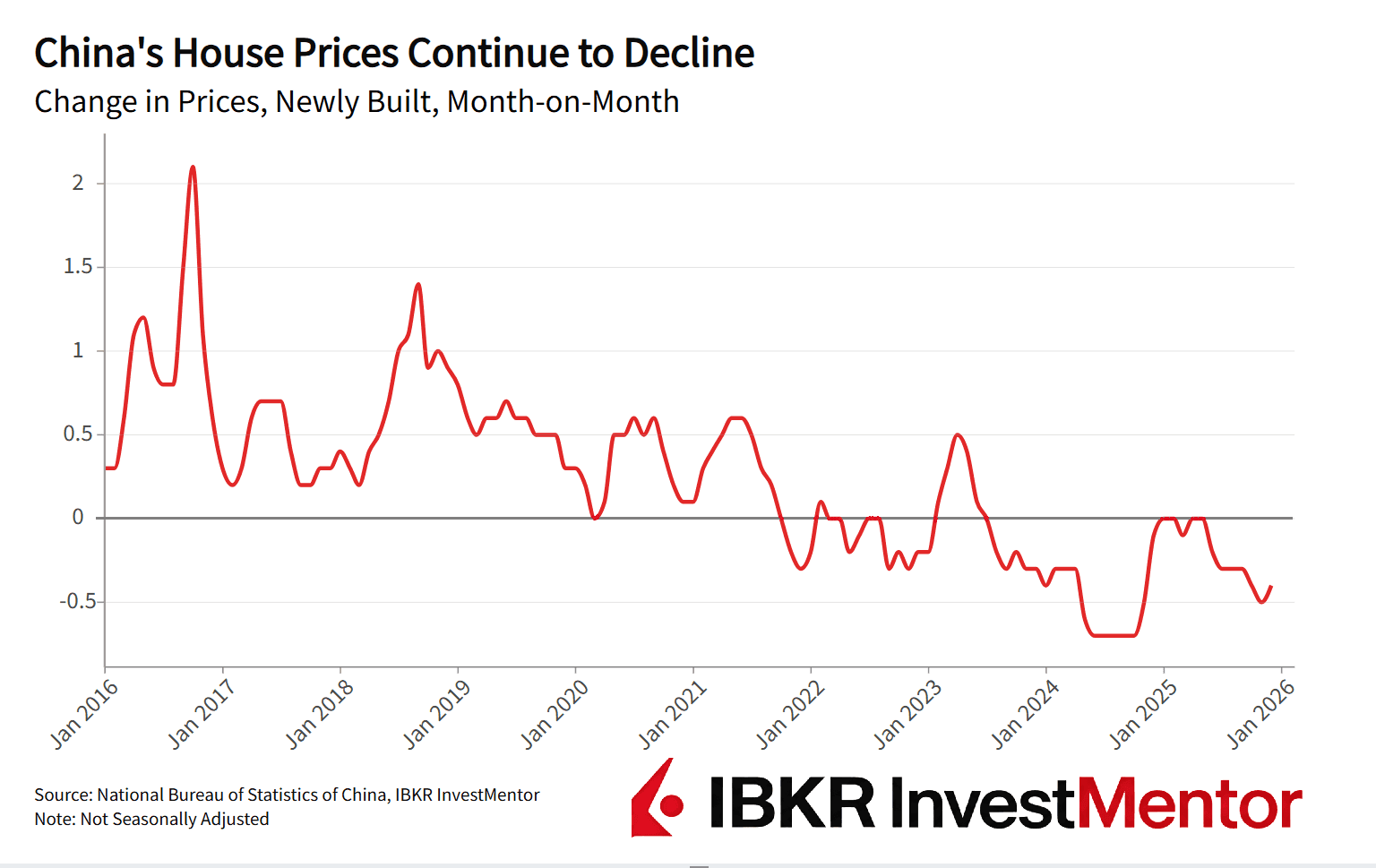

Vanke’s troubles sit atop a wider housing downturn. Official data show China’s new home prices fell 0.4% month‑on‑month in November and 2.4% year‑on‑year, continuing a downward trend that began in mid‑2021.

Existing‑home prices dropped 5–6% from a year earlier, with the steepest falls hitting smaller, third-tier cities. Economists expect national home prices to keep falling into 2026.

This matters because much of the wealth of Chinese households is tied to properties — as much as 70% before the bubble started bursting. Local governments rely on land sales too.

What a Vanke Default Could Trigger

A Vanke default would shake confidence across China’s already-bruised property market. The company operates in over 60 Chinese cities.

Possible consequences:

- Borrowing costs jump for all developers, even state‑linked ones.

- Banks and shadow lenders take losses.

- Homebuyer confidence weakens further, pressuring prices and sales.

- Household wealth is hit, leading to lower consumer confidence.

- Construction delays grow, raising risks of unfinished projects.

- Policymakers may be forced into stronger, costlier support.

When Property Bubbles Burst

China’s story echoes past housing busts worldwide: rapid credit growth, soaring land prices, then painful crashes.

- Japan (1990s): Land and stock bubbles collapsed, triggering a “lost decade” of stagnation.

- US (2008): Subprime mortgage boom imploded, freezing global credit markets.

- Ireland & Spain (2008–12): Construction booms reversed, causing banking failures and EU bailouts.

- East Asia (late 1990s): Property‑linked leverage amplified the Asian Financial Crisis.

China’s twist? As a one-party state, China can step in fast and hard — but it remains to be seen if Beijing wants to support the property sector or let the market take the hit.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.