Introduction

Facing ongoing market volatility, Theodore explores hedging strategies to protect his company's financial stability.

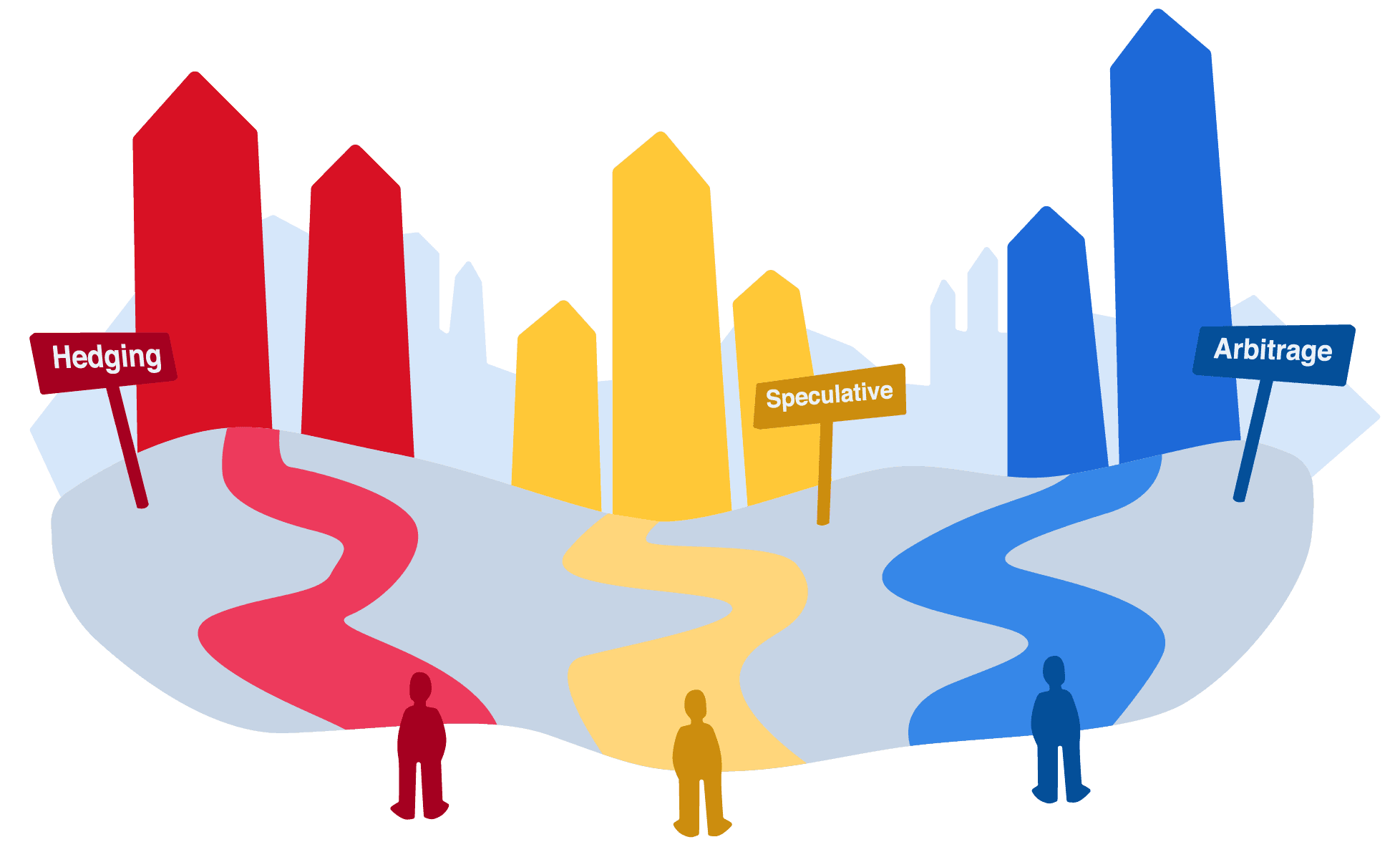

Hedging with futures is a risk management approach to offset potential losses from price fluctuations in commodities or financial instruments.

Participants can lock in prices and secure profit margins by taking an opposite position in the futures market relative to physical market exposure.

This strategy aims to reduce the risk of adverse price changes, ensuring business continuity.