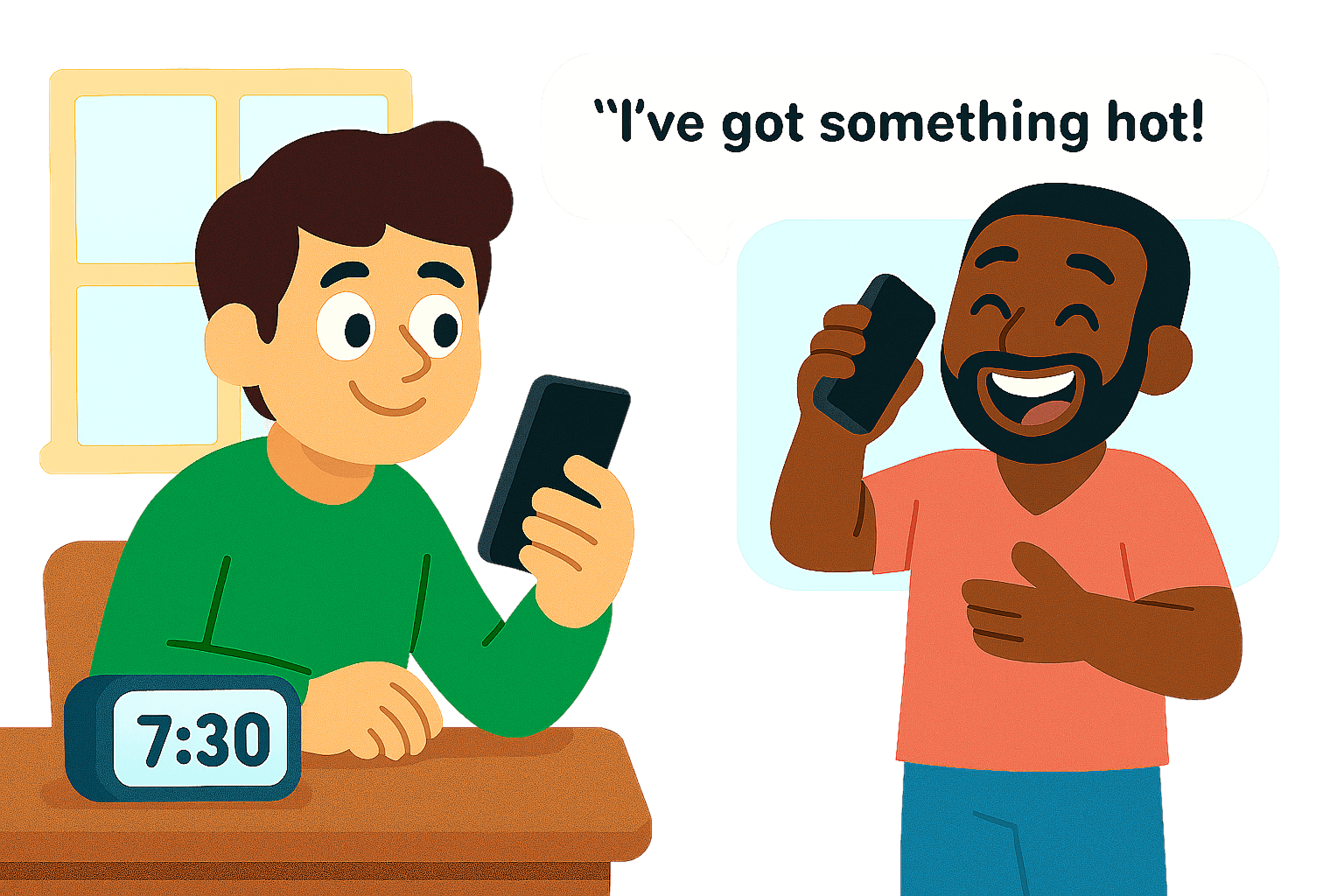

The Hot Tip

Your phone rings at 7:30 AM. it's Marcus, your trading buddy.

"I've got something hot," he says excitedly. "Crude oil futures are trading at $105 per barrel for December delivery. Spot is at $100. With all this tension, we could make a killing!"

You set down your coffee. The $5 spread catches your attention, but you've learned that in futures markets, math beats emotion.

Here's what you know:

- Current Oil Price: $100/barrel

- December Futures: $105/barrel

- Time to December: 6 months

- Interest Rate: 3% per year