Introduction

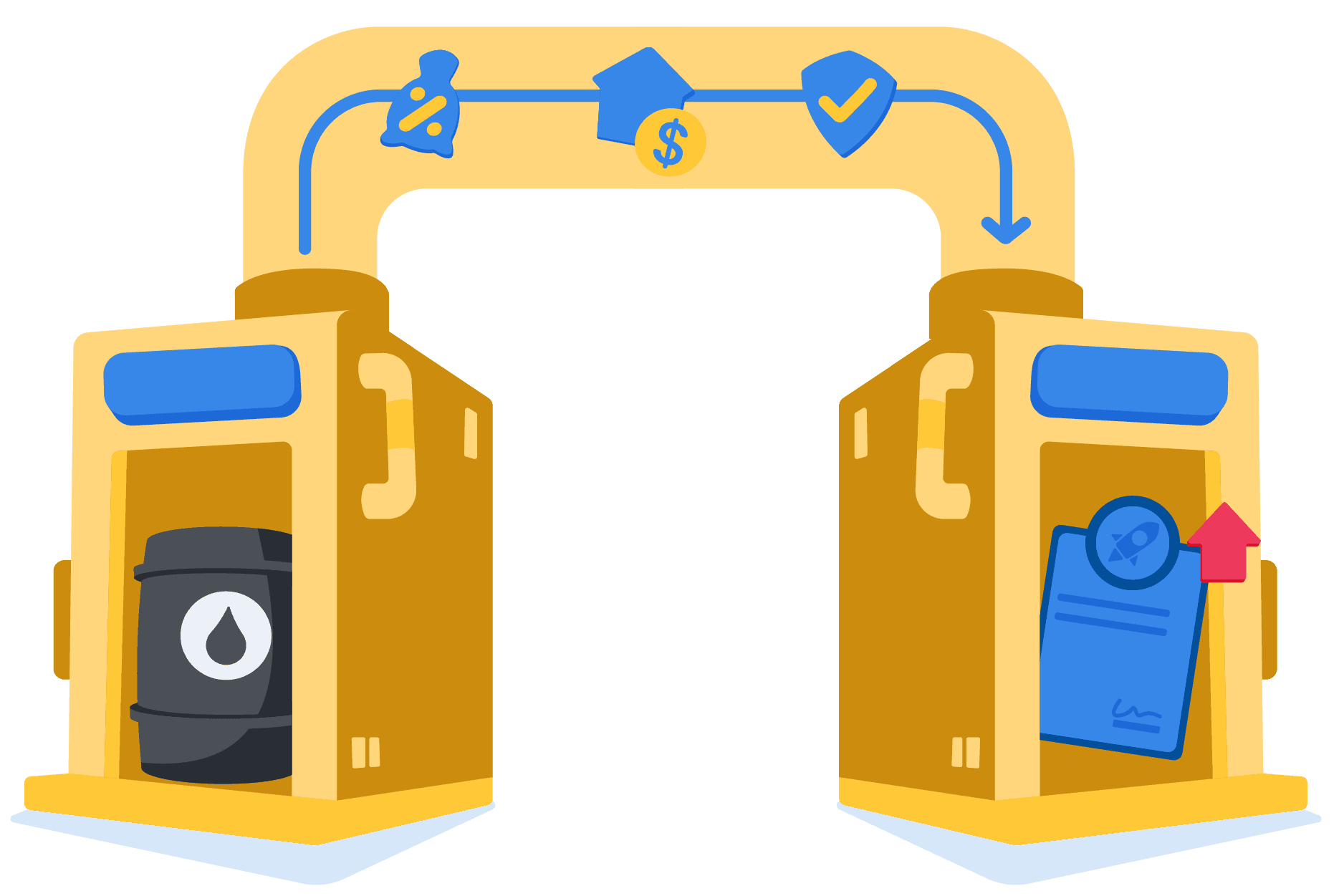

To make informed decisions, Theodore seeks to understand how futures prices are determined.

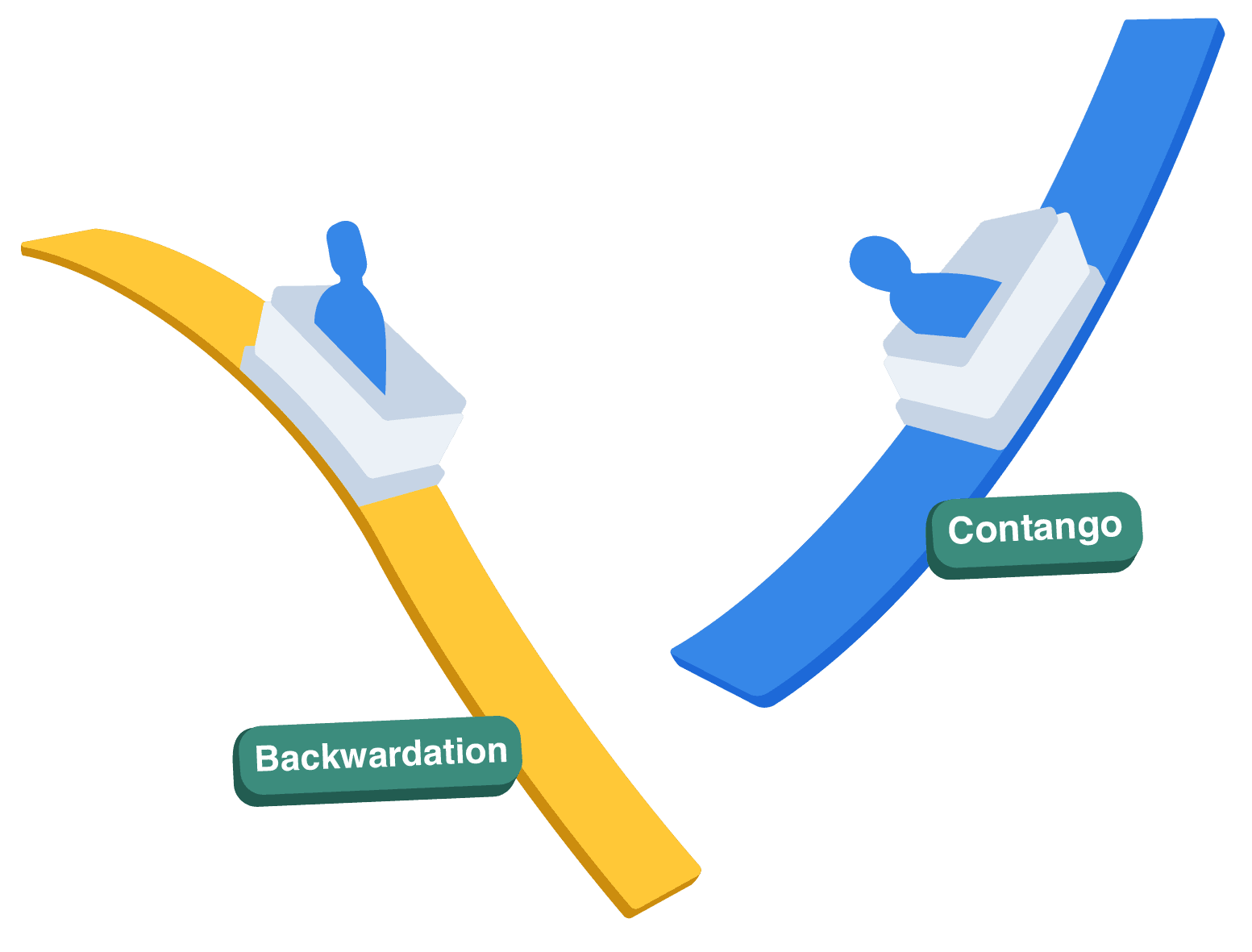

Futures pricing is intrinsically connected to the relationship between spot prices (current market prices) and futures prices (agreed upon today for future delivery).

The primary principle is that futures prices should represent the anticipated future spot price, adjusted for any costs or benefits associated with holding the underlying asset until expiration.