Introduction to Share Ownership

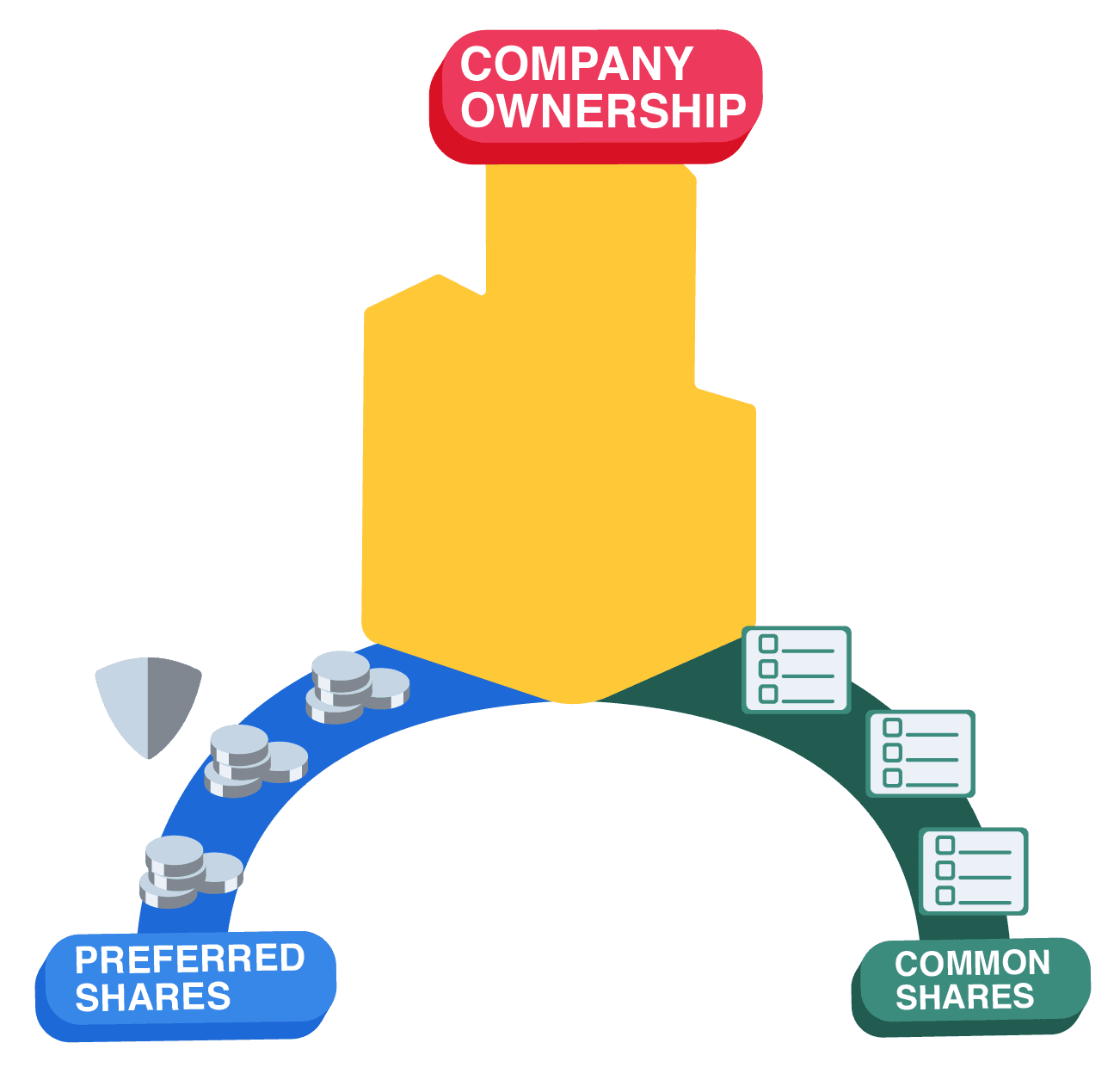

When you buy a share of a company, you're not betting — you’re owning.

A share, or a stock, is a slice of a real business, complete with profits or losses, risks, and a seat at shareholder meetings.

This lesson continues the story of Daniel, a young professional eager to put his savings to work.

Let’s follow him as he discovers what it means to be a shareholder: enjoying the rewards, accepting the responsibilities, and learning how investors shape a company’s future.