Stimulus Bet

11/21/2025

Stimulus Fuels Market Stress in Japan

Japan unveiled a ¥21.3 trillion ($135B) stimulus package — the largest since the pandemic, and even bigger than the finance minister had indicated earlier.

Freshly elected prime minister Sanae Takaichi said stimulus would ease household pain, but markets were rattled across the board:

- 30‑ and 40‑year bond yields hit record highs, at 3.4% and 3.7% respectively

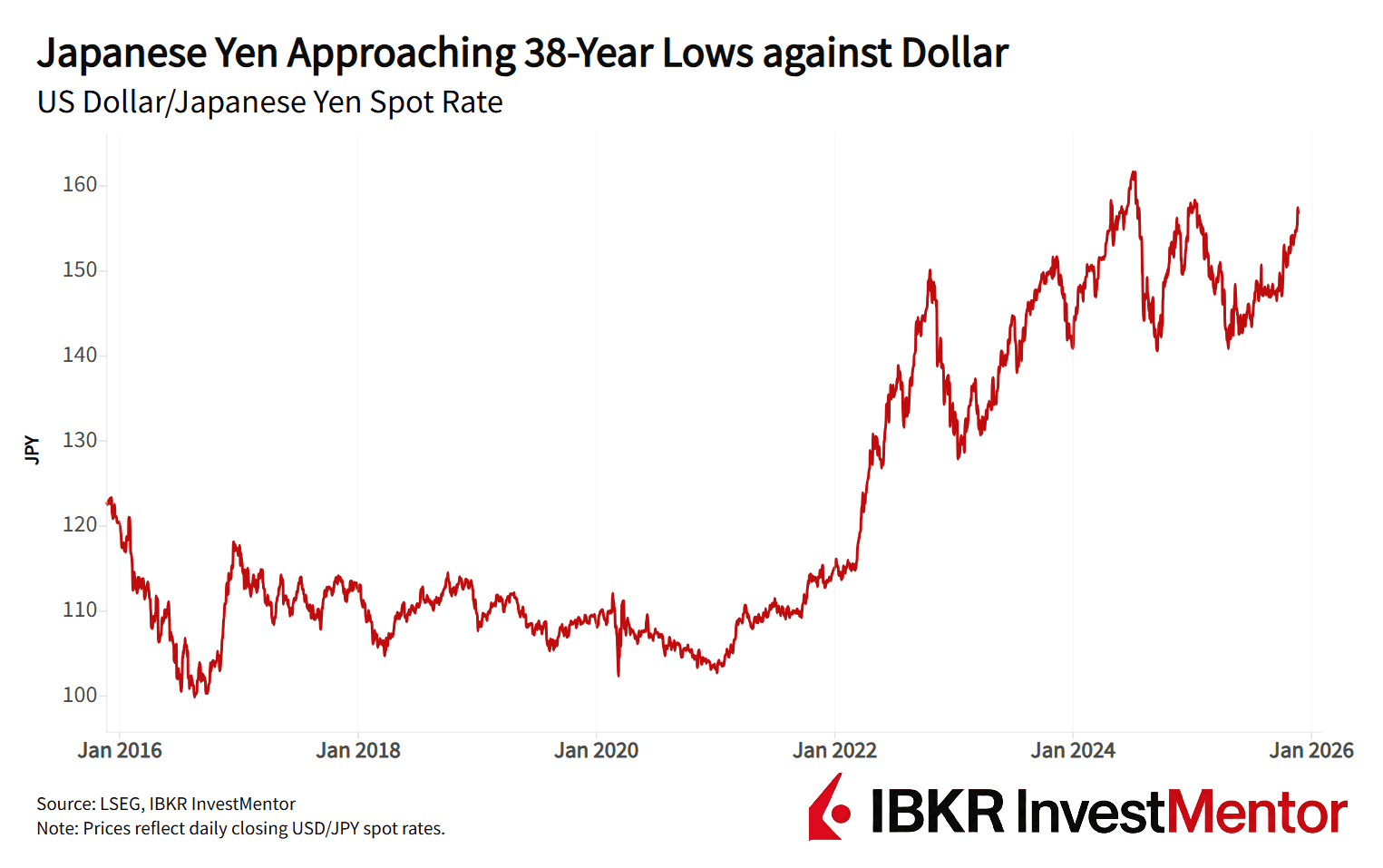

- Yen fell to weakest in 10 months against the dollar and is nearing the lowest point in almost four decades.

- Stocks faltered, with Nikkei 225 index down 2.4 percent.

Often stimulus lifts confidence, yet here it’s fueling worries about debt and inflation.

Stimulus Plans Risk Backfiring

The government stimulus plans include energy subsidies and cash handouts to families, squeezed by inflation. But more government spending means more borrowing, which weakens the yen.

A weaker yen makes imports pricier, especially oil and gas, which could at least partly cancel out subsidies.

More money flowing into the economy also risks pushing inflation higher. This could force the Bank of Japan (the central bank) to hike interest rates as soon as December — the opposite of what the prime minister wants.

BoJ and PM Keep Talks Calm for Now

Bank of Japan governor Kazuo Ueda had his first formal meeting with Takaichi earlier this week. The two kept it cordial and “candid”, according to Ueda, with the PM not trying to step on the central bank's turf, despite her earlier statements. This is important for investors who tend to value the independence of central banks.

The BoJ continues to gradually raise rates to guide inflation smoothly to its 2% target, he said. Inflation stood at 3.0% in October, a full percentage point above the central bank target.

The retail price of rice, a household staple in Japan, hit record highs in November, adding further pressure for the BoJ to act fast.

Debt-Fueled Stimulus, Currency Strain

The Japanese government debt level is the highest among advanced economies. Much of this is held domestically, tempering the risk of a debt crisis, but the government is about to embark in a borrowing spree as yields are rising.

Since Takaichi’s election in October, the yen has dropped about 6.5% against the dollar. Finance minister Satsuki Katayama has hinted at stepping in — potentially a third currency intervention in three years — to stem the slide and reassure markets.

Risks Loom for the World’s Fourth Largest Economy

Pros:

- Households and corporates hold vast savings, providing resilience.

- Technologically advanced society, with social cohesion and stability

- Public debt largely held by the Bank of Japan and domestic investors.

Cons:

- Government debt around 240% of GDP, the highest among advanced economies.

- Yen weakening sharply, raising import costs and inflation risks.

- Ageing, shrinking population weighs on growth. Almost 30% of population is over 65 years old.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.