US Unrate

11/20/2025

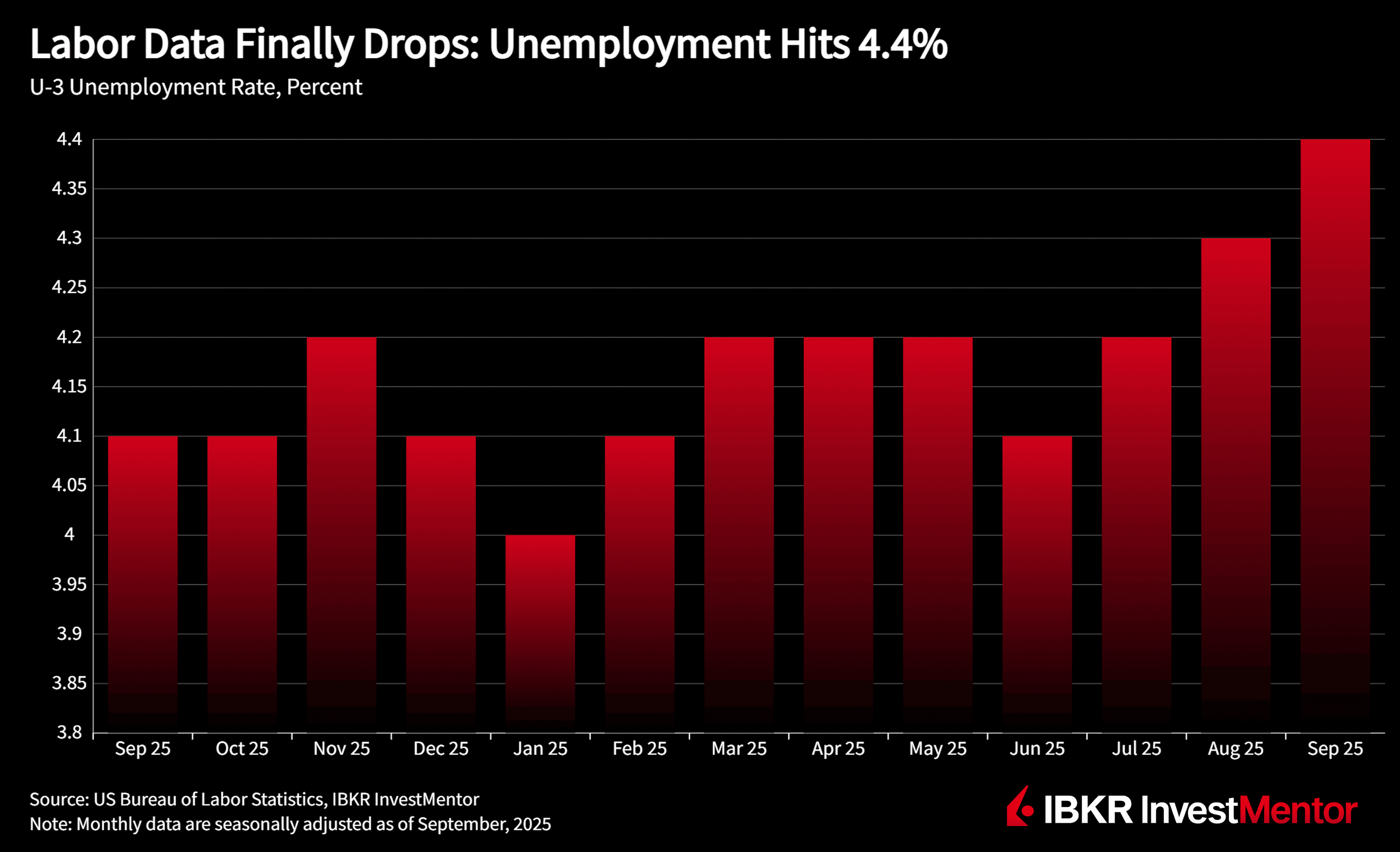

After a six-week delay due to the government shutdown, September's employment report showed nonfarm payrolls rose by 119,000, a modest gain confirming the hiring slowdown prior to the shutdown. The unemployment rate increased to 4.4% from 4.3%, now higher than the 4.1% recorded a year ago, pointing to gradual loosening. Sector performance was mixed:

Expanding sectors:

- Health care: +43,000 jobs

- Food services and drinking places: +37,000

- Social assistance: +14,000 (primarily individual and family services)

Contracting sectors:

- Transportation and warehousing: -25,000 (driven by warehousing, storage, and courier declines)

- Federal government: -3,000 (down nearly 100,000 from January peak)

Wage growth remains steady but subdued. Average hourly earnings rose 0.2% in September and 3.8% year-over-year, while the average workweek held at 34.2 hours. The data collectively depicts a labor market in transition, cooling gradually but maintaining stability. With the shutdown preventing October data collection, September's report carries added weight for policymakers and markets until November for figures to arrive, making this release particularly consequential for near-term policy decisions.

Beyond the headline unemployment rate lies a more complete picture of labor market health. The gap between the standard and broader measures of unemployment reveals the extent of underemployment and workforce detachment that headline figures can obscure details that matter significantly for assessing the economy's true capacity and the pressures facing workers.

The official unemployment rate (U-3) stood at 4.4% in September, measuring those without jobs who are available and actively seeking work. However, the U-6 figure came in at 8.0% providing a broader perspective on labor underutilization by including:

- All U-3 unemployed

- Discouraged workers who've stopped searching, believing no jobs are available

- Other marginally attached workers who want work, are available, and searched in the past 12 months but not the past four weeks

- Involuntary part-time workers who want full-time employment but can't find it

Key distinction: U-3 captures clear unemployment; U-6 reveals hidden slack, workers sidelined or underemployed. A rising U-3 signals increasing joblessness. An elevated U-6, even with moderate U-3, indicates many workers may be trapped in part-time roles or discouraged from searching, potentially weighing incomes and demand.

September’s jobs report and the Fed’s quarter-point cut paint a picture of an economy easing off the boil rather than falling off a cliff. Job growth has basically stalled since April, unemployment has drifted up from 4.1% to 4.4% over the past year, and the wider U-6 measure at 8.0% shows there’s more slack and underemployment than the headline suggests.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.