HK Tragedy

11/27/2025

Hong Kong Blaze Sparks Property and Insurance Fears

A fire in Wang Fuk Court apartment complex in Hong Kong has killed at least 65 people, with nearly 300 still accounted for, making it the city’s deadliest fire in decades.

The complex, part of a subsidized home‑ownership scheme, was under renovation when flames spread across bamboo scaffolding.

Beyond the tragic human toll, the disaster raises questions about infrastructure safety standards and property market risks in one of the world’s most expensive housing markets.

Safety Failures Raise Costs

Hong Kong police say unsafe materials used by a construction firm may have worsened the blaze, leading to arrests for manslaughter.

Developers in Hong Kong, and potentially mainland China, now face the prospect of tougher rules, higher compliance costs, and reputational damage.

Britain’s Grenfell Tower fire offers a precedent: construction firms were forced to fund repairs for unsafe cladding, and the government tightened oversight after 72 people lost their lives in the fire. For Hong Kong, stricter standards could reshape how projects are financed and priced, with long‑term effects on the property sector.

Claims and Risk Repricing

Insurers will face claims from thousands of residents who lost homes and belongings. Many lost their loved ones or suffered life-changing injuries. The scale of damage may prompt higher premiums and stricter underwriting for high‑rise housing.

The Hong Kong insurance regulator has set up a task force to speed up the processing of the claims, which could reportedly exceed 300 million US dollars.

Investors should watch how insurers absorb losses and whether regulators push for stronger protections. Disasters like London's Grenfell in 2017 showed how liability disputes can drag on for years, with criminal prosecutions not due to start until 2026.

Tragedy Tests Hong Kong as a Global Hub

Hong Kong’s property market is central to its role as a financial hub. Today’s tragedy may accelerate reforms, with politicians under pressure to show the city is a responsible landlord and a safe place to invest — especially with Hong Kong legislative election coming up next month.

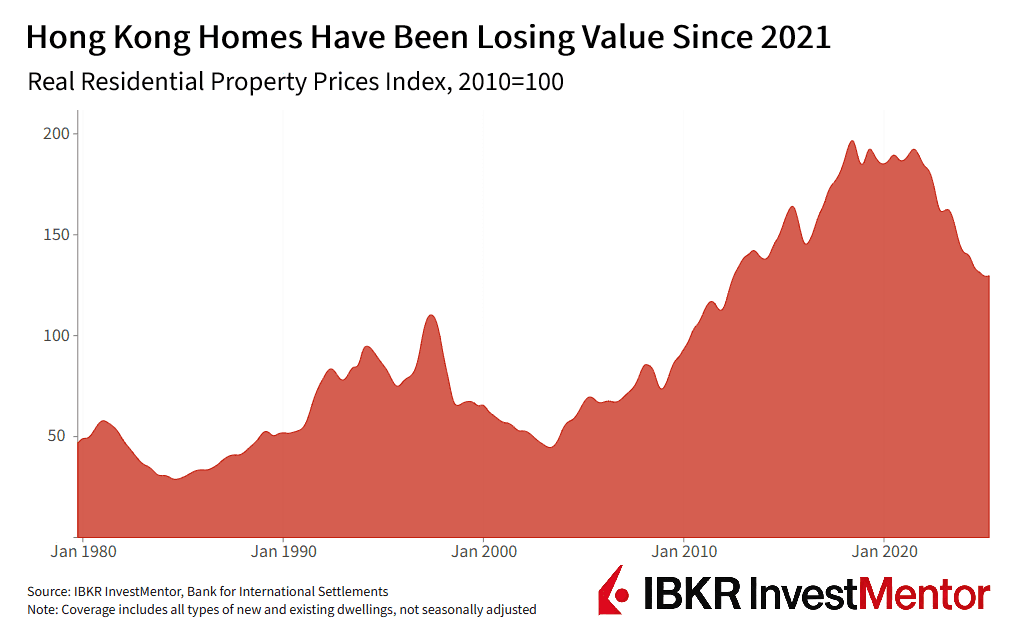

Hong Kong has not been immune to the ongoing property crisis in China: with prices in the city falling since the pandemic peak. But it still often tops the charts as the most expensive city in the world for housing, with land for new buildings scarce.

Officials have tried to crack down on so-called “subdivided flats”, with some as small as a single bed and yet still leased for high rent.

Vanke Woes Revive Market Fears

China’s property sector has been in turmoil since a liquidity crunch hit developers in 2021, triggering defaults at giants like Evergrande and Country Garden.

Now, state‑backed China Vanke is under strain: its shares and bonds plunged after the company sought to delay debt repayment, raising fears of restructuring. If Vanke falters, the shock could ripple across the country, and test Beijing’s ability to stabilize the $19 trillion economy.

- China's new home prices fell 0.5%, at the fastest monthly pace in a year, in October

- Prices were down 2.2% year-on-year

- Property investments saw a steep decline of 14.7% year-on-year

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.