Ballot Boost

10/27/2025

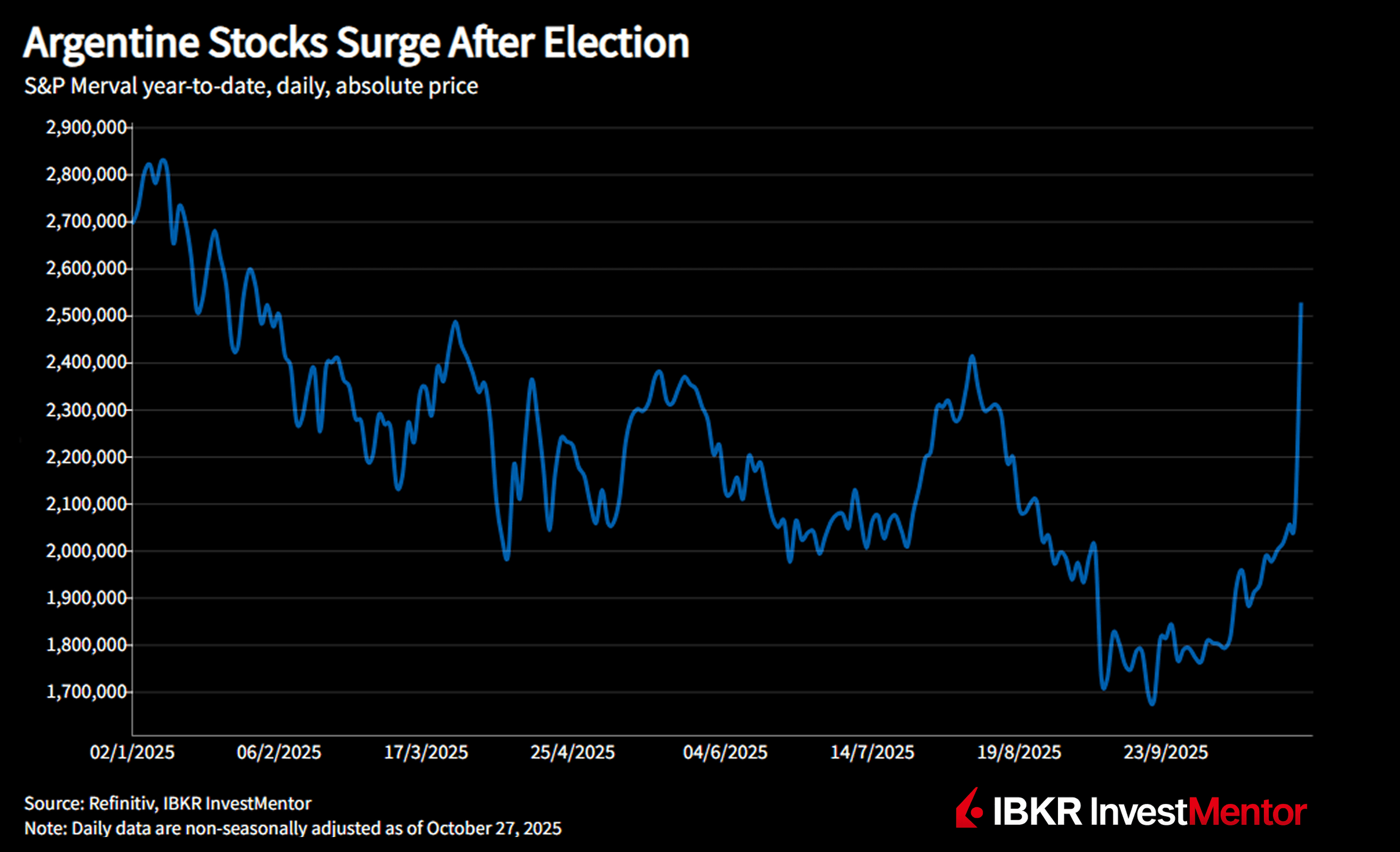

Argentine Markets Surge After Milei’s Midterm Win

Argentine assets rallied sharply Monday after President Javier Milei’s party scored a decisive victory in midterm elections — a result seen as critical for advancing his free-market reform agenda.

- Government bonds soared across maturities, reversing recent losses

- Local stocks surged over 20% — one of the strongest sessions ever

- U.S.-listed Argentine shares soared, with some financials up 50%

- Peso strengthened more than 10% against the dollar

US Pledge Fuels Reform Bets

Argentina’s rally was buoyed by a $40 billion US support package — a $20 billion central bank swap line and a potential $20 billion loan facility. The White House has implied that this backing is tied to Milei’s reform agenda staying on track.

The endorsement provides credibility to the reform push and reassures investors that external support may buffer short-term volatility. It also signals that Washington sees Milei’s leadership as a viable path to macroeconomic stability.

Why Such a Strong Reaction?

Argentina’s market reaction wasn’t just about the election win — it was about what the win unlocked.

- The victory was much more decisive than polls predicted

- Milei’s party managed a surprise win in key Buenos Aires province, signaling broad support

- A more cooperative tone from Milei signals less political risk

- US financial backing is tied to reform progress, and increases hopes for faster currency and fiscal reforms.

Together, these elements created one of the strongest single-day rallies in recent Argentine market history.

Investors Eye Currency Overhaul

It has been a rollercoaster year for Argentine markets, with the peso down nearly 30% against the US dollar before the election.

A stronger peso could now help rebuild the depleted dollar reserves.

Milei’s government will face pressure to reform the foreign exchange regime, potentially widening the peso’s trading band or even considering a freely floating currency.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.