Rate Watch

11/6/2025

BoE Holds But Signals December Cut

The Bank of England held interest rates at 4.0% in a narrow 5–4 vote, with Governor Andrew Bailey casting the deciding vote in favor of keeping the cost of borrowing unchanged.

The central bank signaled a potential cut in December. Bailey said inflation risks in the UK are easing, but “further evidence” is needed.

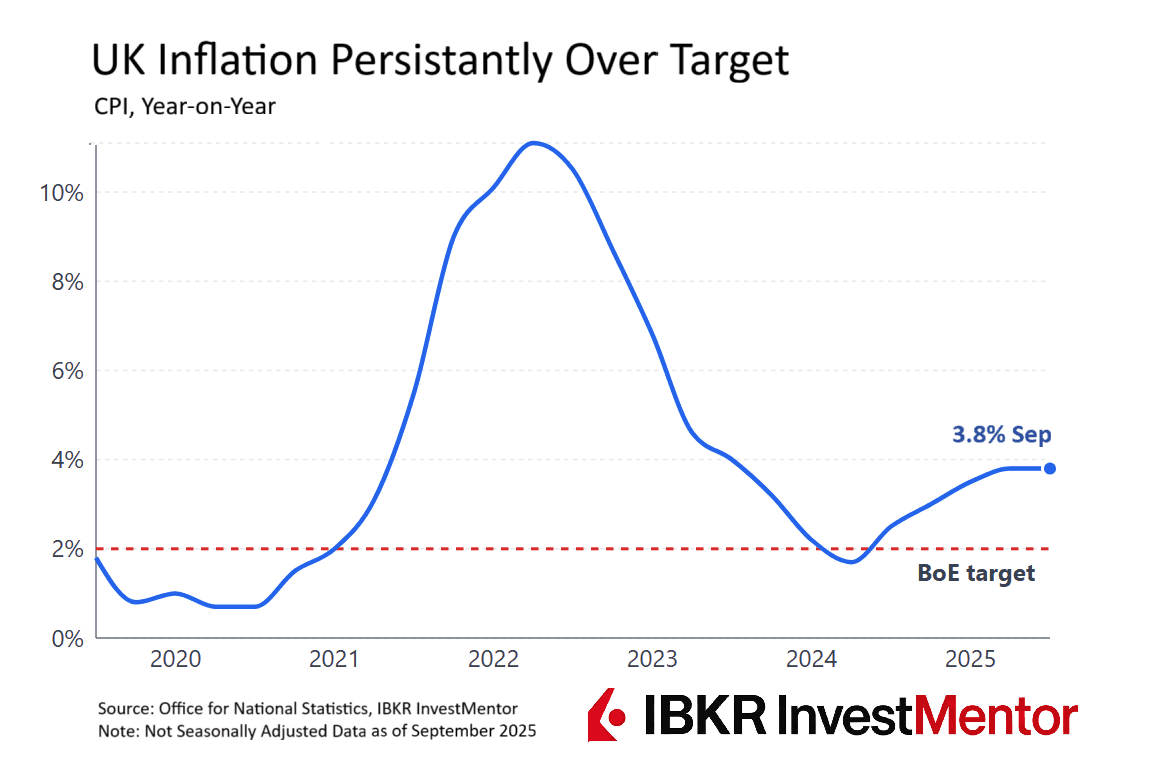

Inflation remained steady at 3.8% year-over-year in September and is expected to fall in October and November. At the next meeting, policymakers will have more clarity on the upcoming UK budget and the jobs market, too.

Why Is UK Inflation Still So High?

The UK’s annual inflation rate is higher than in the US or the Eurozone, and among the highest of all advanced economies.

Main drivers:

- Sticky services prices

- Strong wage growth

- Lingering food cost pressures

The UK saw sharper post-pandemic spikes in energy and food prices, and its job market overheated more than its peers. It has also tackled labor shortages and higher trade costs after Brexit, Britain’s separation from the European Union.

Government Mulls Breaking 50-Year Tax Taboo

UK finance minister Rachel Reeves is expected to unveil tens of billions of pounds of tax hikes when she delivers the budget on 26 November. She could even break the 50-year taboo on raising the basic rate of income tax, reversing campaign pledges.

Other potential tax changes:

- Fuel duty: Ending the freeze could raise billions.

- Taxes on wealthy: Higher rates on capital gains and properties.

- Pensions: Cuts to tax-free lump sums and new levies on employer contributions.

- Exit tax: A proposed 20% levy on wealthy individuals leaving the UK.

- “Sin” taxes: Hikes on alcohol, vaping, gambling, and air travel.

Very British Budget Day

The annual budget reveal is one of the most significant days in British politics. The finance minister — known as the chancellor of the exchequer — outlines in a speech to the parliament her plans to tax, spend, and steer the economy.

Before that, she poses outside 11 Downing Street (next door to the more famous No. 10, the prime minister’s residence) holding the red budget box. It’s not just for show: the lead-lined briefcase carries her speech, continuing a tradition that dates back to the 1860s.

It’s part theatre, part policy. Expect surprise announcements known as “rabbits out of the hat”, fierce debate, and market reactions.

Chancellor's Tough Choices

With the budget day looming, the chancellor faces tough choices on how to fund strained public services and manage growing public debt, at around 95% debt-to-GDP. Should taxes go up, or is there a better way to balance the books?

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.