Air Risk

12/1/2025

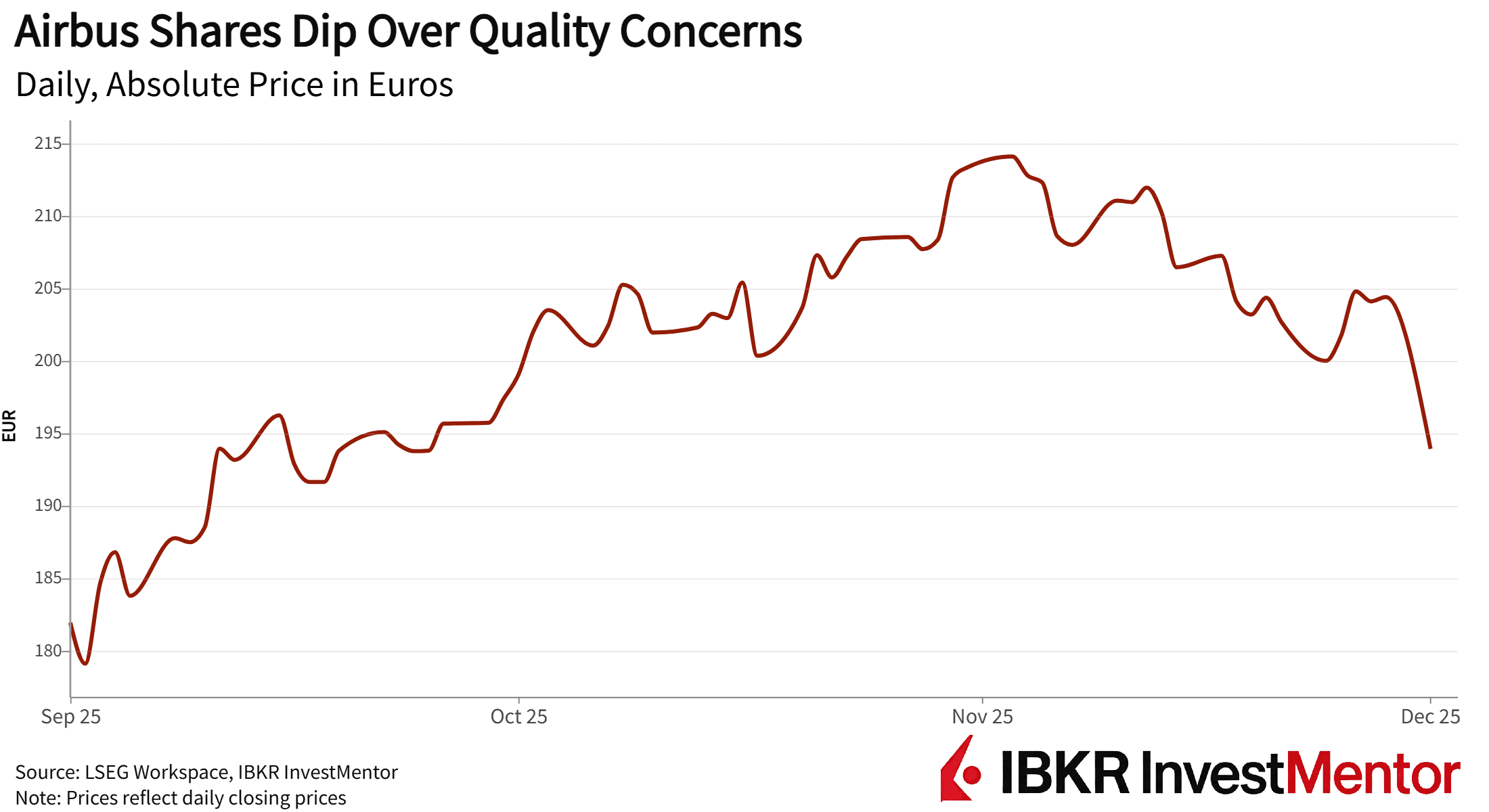

Airbus Shares Plunge on New Flaw

Airbus had a rough start to the week, with the shares falling as much as 10% on Monday after reports of a quality issue on the metal panels of some of its A320 jets, impacting deliveries.

This came just days after a global software recall grounded 6,000 aircraft. Even though the glitch, linked to vulnerability to solar flares, was quickly fixed, investors punished the company.

No serious incident was tied to the flaw, but the episode shows how sensitive aerospace stocks are to safety headlines: a single defect can erase billions in market value.

Boeing’s Long Shadow Over Aerospace Sector

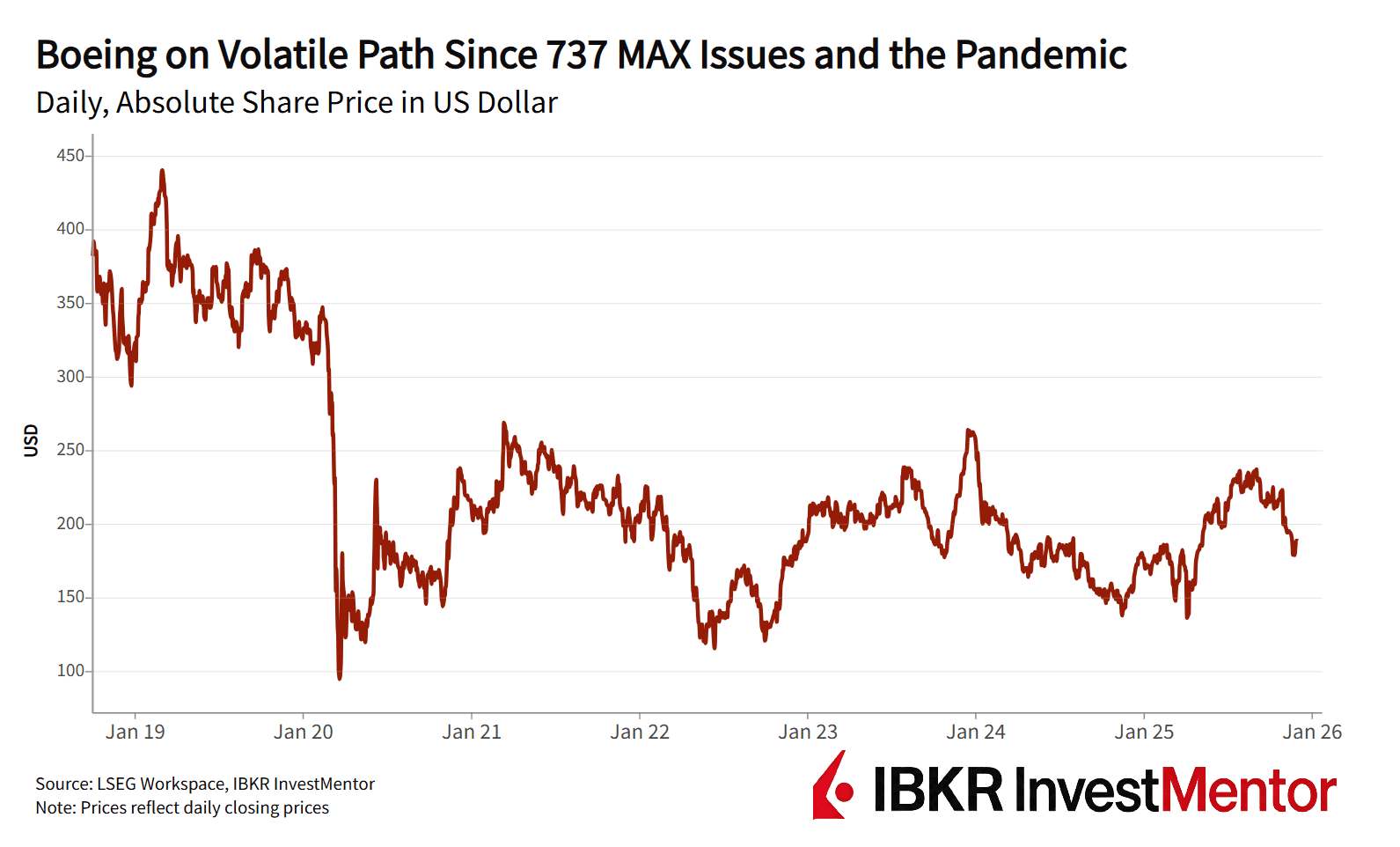

Boeing’s 737 MAX crisis remains the industry’s modern cautionary tale.

Two crashes in 2018–19 led to a worldwide grounding, lawsuits, and reputational damage. The fallout cost Boeing tens of billions, with deliveries halted and trust eroded.

Even years later, regulators, airlines, and investors probe Boeing more closely. In January 2024, an Alaska Airlines 737 MAX 9 suffered a mid‑air blowout when a door plug separated, forcing an emergency landing.

The incident reignited scrutiny of Boeing’s quality controls, underscoring how reputational scars linger.

Two Giants Ruling the Jet Market

Aircraft manufacturing is a global industry, but two winged giants soar above the rest. Airbus (Europe) and Boeing (US) together control nearly all of the commercial jet market.

In regional smaller jets, companies like Embraer in Brazil and COMAC in China have managed to carve out a niche. But for investors, the sector’s performance largely hinges on the transatlantic rivalry of Airbus and Boeing.

Before the recent troubles, Airbus had been on the rise. Last month, A320 planes became the most-delivered jetliner type in history, surpassing Boeing's 737.

Big Backlogs, Bigger Risks

At the end of Q3 2025, Airbus had a backlog of 8,665 aircraft, while Boeing’s stood at over 5,900. For context, Airbus delivered 766 jets last year versus Boeing’s 348.

Backlogs signal strong long‑term demand, with airlines planning fleets years ahead, but revenue only comes when planes are handed over. With narrow‑bodied jets priced near $100 million and wide‑bodies around $300 million, each delivery is critical.

Supply chain fragility, safety crises, or regulatory delays can push schedules out. For investors, backlogs highlight demand but also underline the risk that execution may fall short.

What It Means to Buy Plane Stocks

Investing in plane makers is not just about tracking passenger growth.

Main risks include:

- Safety record: Flaws or crashes can halt fleets.

- Supply chains: Materials and parts like titanium and semiconductors are vulnerable to disruption.

- Labor: Shortage of employees can undermine targets. Machinist strikes have slowed Boeing in recent years.

- Regulation: Global oversight adds complexity, with stricter rules after accidents.

- Cycles: Demand rises and falls with travel and economic growth.

Shocks like the COVID‑19 pandemic can bring global air travel to a standstill, crushing demand for new jets. Plane makers depend on the health of airlines.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.