CME Frozen

11/28/2025

Trading in the Dark

A cooling issue at CyrusOne data centers froze CME Group’s platforms for up to 11 hours, disrupting derivatives trading in foreign exchange, commodities, treasuries, and stocks. Benchmarks for oil, gold, and the S&P 500 futures stopped updating, leaving traders staring at frozen screens.

Brokers pulled products or relied on internal estimates, with much of the trading stopped altogether.

The outage showed how global markets depend on fragile tech infrastructure, particularly data centers.

From Crops to Gold: CME Group’s Reach

CME Group, headquartered in Chicago, is the world’s largest exchange operator by market value and a cornerstone in the global financial infrastructure. It runs four major derivatives exchanges, handling on average 26 million contracts daily.

- Chicago Mercantile Exchange (CME): Global futures on currencies, interest rates, stock indexes, crypto, and commodities.

- Chicago Board of Trade (CBOT): Agricultural contracts like corn, wheat, and soybeans.

- New York Mercantile Exchange (NYMEX): Energy benchmarks like crude oil, natural gas, and refined fuels.

- The Commody Exchange (COMEX): Metals futures for gold, silver, copper, and more.

Markets Blindfolded by CME Freeze

The CME glitch froze trading across a huge range of futures and options, and halted the EBS foreign exchange platform, which handles about $60 billion of trades daily.

- With no live quotes, brokers suspended contracts or relied on internal estimates.

- Liquidity can dry up when benchmarks freeze.

- Volatility often follows when markets reopen.

Why this matters: These contracts help businesses and investors hedge, speculate, and set prices daily. US stock index futures, for example, are heavily traded before the market open. On Friday, traders had to gauge sentiment from index‑tracking ETFs instead.

Trillions Needed, But Power Runs Short

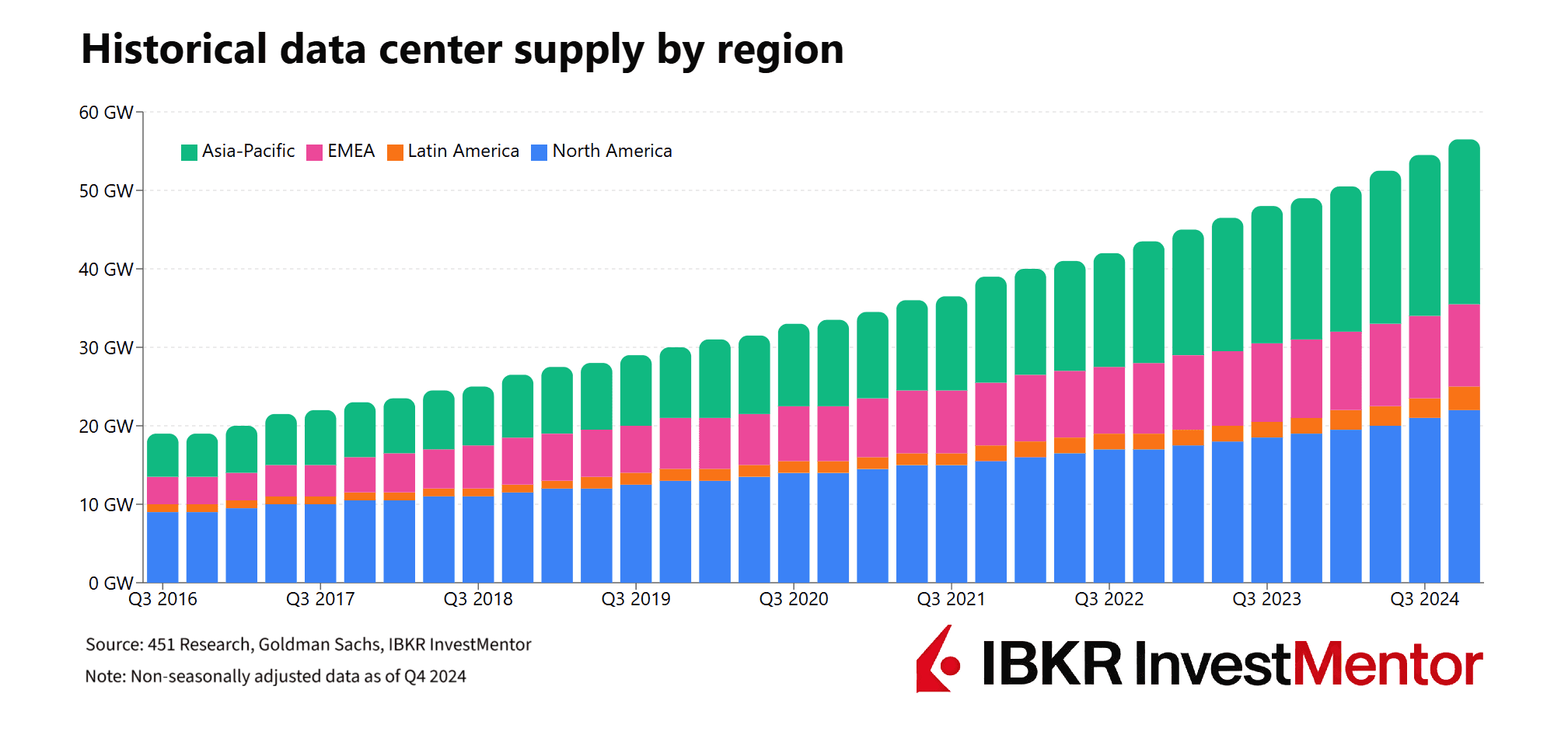

The digital economy runs on data centers. They power trading, payments, AI, and streaming. The CME outage proved how a simple cooling failure can ripple across finance.

As the build-up accelerates, reliability is increasingly in focus:

- McKinsey: $7 trillion global data center investments needed by 2030 to keep up with soaring demand for computing power.

- Goldman Sachs: 165% rise in global power demand from data centers by the end of the decade, driven by AI.

- Morgan Stanley: 20% power shortfall in US data centers by 2028 (≈13 GW, enough to power 13 million homes).

Lucky Timing for Black Friday Outage

CME has faced outages before: in 2014, agricultural contracts were halted. In 2024, London’s LSEG and Switzerland’s SIX exchange also suffered interruptions.

This time, the outage occurred early hours after the Thanksgiving holiday in the US. Even before the glitch, the trading day was going to be a quiet one, with unusually low trading volumes limiting the impact.

The outage coincided with the year’s biggest online shopping bonanza Black Friday, a period of unusually high online activity.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.