Pharma Feud

11/24/2025

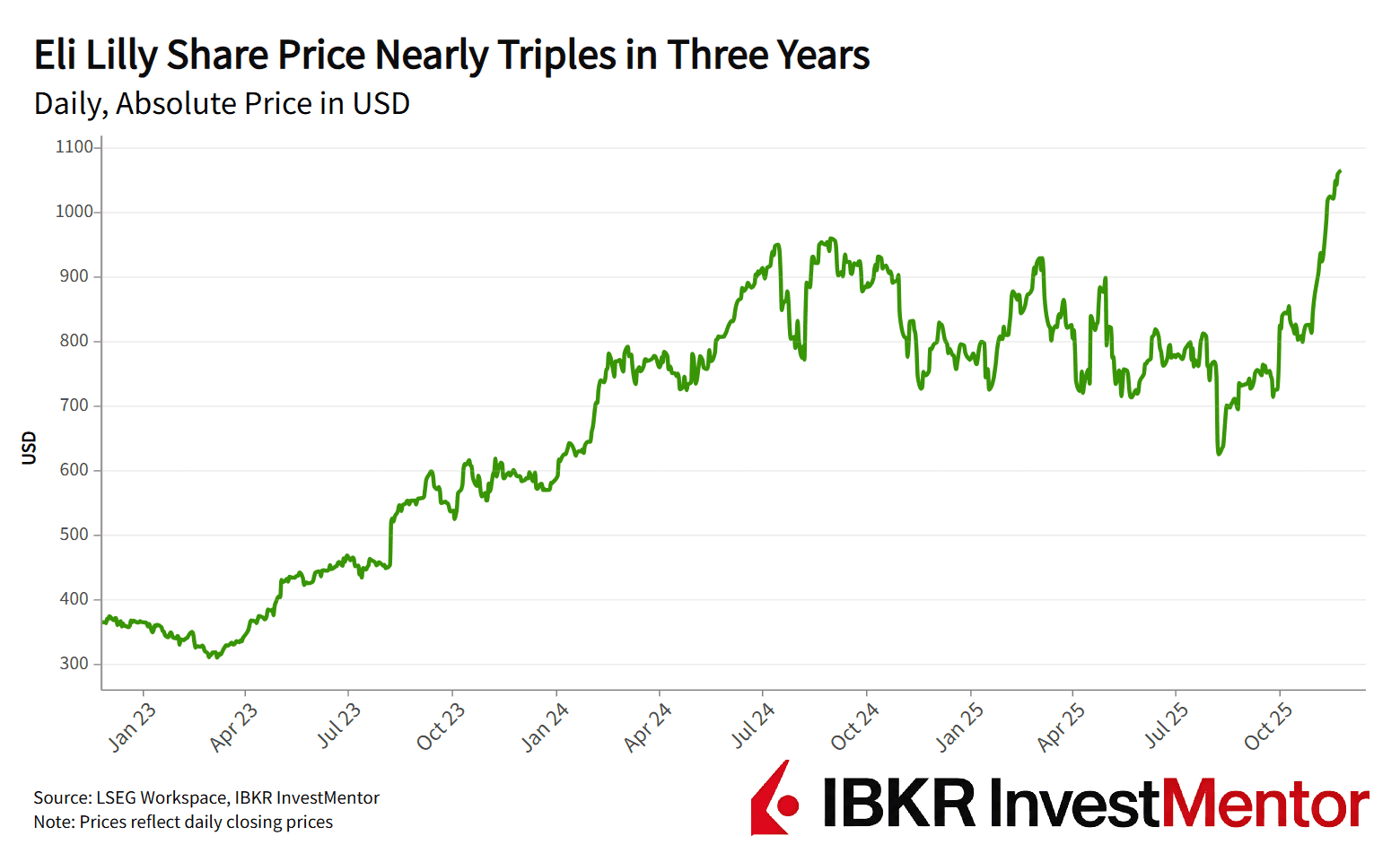

Eli Lilly Reaches $1 Trillion Milestone as Rival Stumbles

American drugmaker Eli Lilly has become the first pharmaceutical company to reach a $1 trillion market cap, a level usually reserved for tech giants.

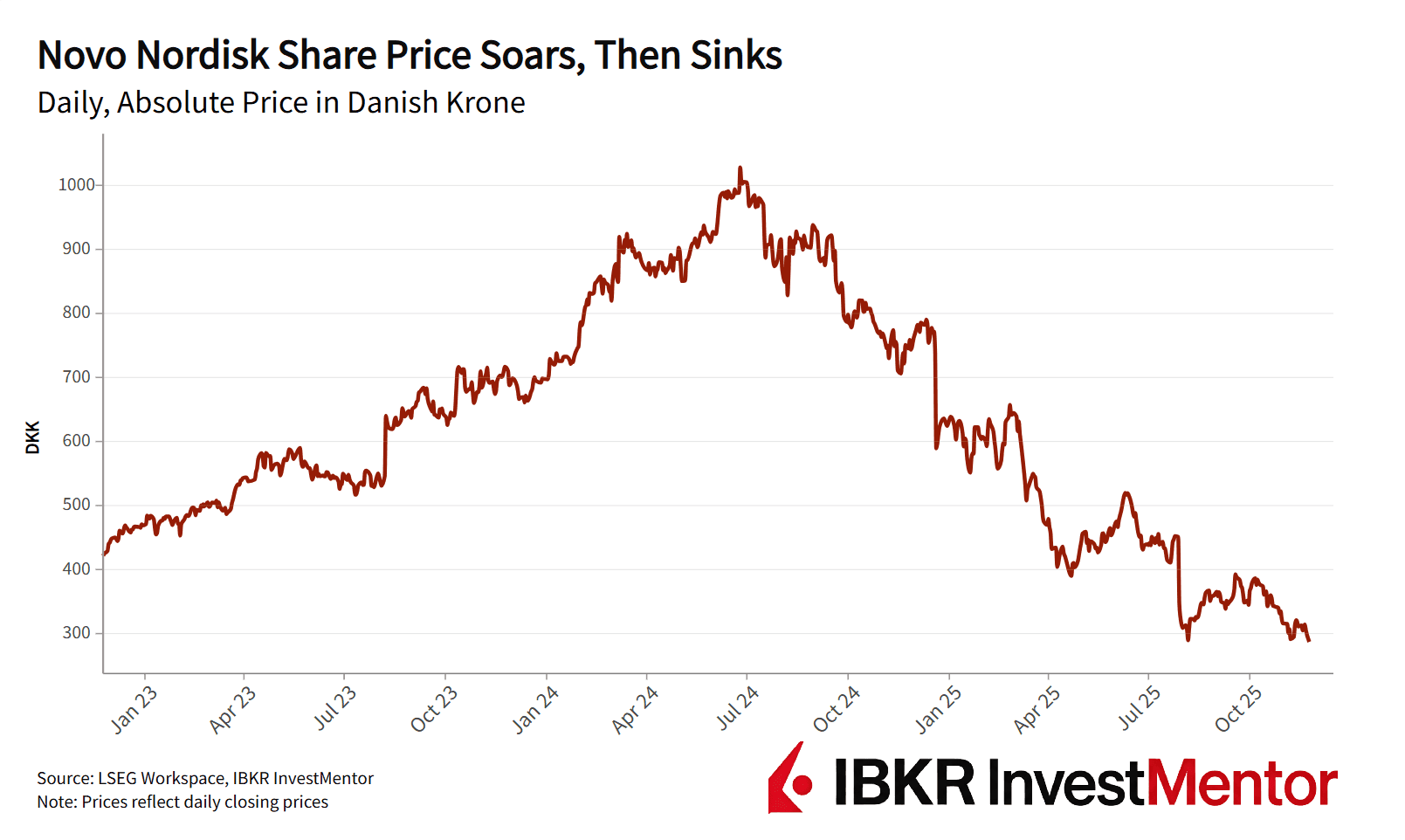

Lilly’s surge comes from blockbuster diabetes and weight‑loss drugs. Meanwhile, main rival Novo Nordisk has lost more than 70% of its value since peaking in June 2024, despite being the first in the market for the new wave of obesity treatments.

This tale of two stocks shows how fortunes in pharma can swing dramatically depending on science, patents, and execution.

Alzheimer Setback Deepens Slide

Novo Nordisk briefly dominated the weight-loss boom with Ozempic and Wegovy, often endorsed by social media influencers. Briefly, it looked like Denmark had produced a global champion.

But despite the viral buzz, supply shortages and weaker clinical results let Lilly pull ahead.

The latest blow came on Monday: trials using a pill version of Ozempic to treat Alzheimer’s failed — sending shares down as much as 10%. Alzheimer’s is a huge unmet market, but success rates for drugs are notoriously low.

Historic Growth out of Weight-Loss

Lilly’s tirzepatide medicines, which mimic gut hormones to suppress appetite and improve metabolism, have transformed its business in a couple of years.

Mounjaro (for diabetes) and Zepbound (for weight-loss) together generated over $10 billion in revenue last quarter, more than half of total revenue. Oral versions could arrive next year, further driving the sales.

Globally, the obesity drug market could reach $150 billion by 2035, according to Morgan Stanley Research, making it one of healthcare’s fastest‑growing segments.

Pharma’s High‑Risk Development Cycle

The story of Lilly and Novo shows how the healthcare sector hinges on breakthroughs, patents, and execution.

Key factors to consider:

- Clinical trials: many promising drugs fail in late‑stage testing.

- Patents: once they expire, revenues fall off a “patent cliff.”

- Regulatory approvals: drugs must clear strict safety and efficacy reviews.

- Reimbursement: even approved drugs need coverage from insurers or health systems.

- Pipeline: future drugs matter as much as current ones.

- Production capacity: Novo Nordisk failed to respond to the huge demand quickly enough.

Europe’s One Trillion Dollar Dream Slipping Away

Novo Nordisk briefly became Europe’s most valuable company, driven by demand for weight-loss drugs. But American rival Eli Lilly has now surged ahead, becoming the first pharmaceutical firm to hit a $1 trillion market cap.

Dutch ASML, a supplier of chip-making equipment, is now in the top spot in Europe but far below the one trillion threshold at around $370 billion.

This tale of two feuding pharma companies highlights how European firms still struggle to create value on par with their American counterparts.

Want to explore more? Download our free app to unlock expert news updates and interactive lessons about the financial world.